The financial services industry talks a big game about its use of AI, but our analysis reveals that this talk remains vague and fails to address emerging consumer privacy concerns.

The problem: In the UK, 50% of consumers say they don’t feel comfortable with their financial services provider using AI. In the US, the figure is pretty similar. Why is that? Is it the case that banks, insurance providers or fintechs can’t afford to invest in high-quality AI, unlike the rest of the world’s most profitable industries?

No, we don’t think so either.

The problem lies elsewhere – in the way financial services firms communicate about their use of AI.

Our analysis of 521 English-language articles published in the last 12 months shows us how finance players – including banks, insurers, credit unions, savings and loan associations, and fintechs – are talking about AI.

Download Commetric’s media analysis report to uncover how financial services can bridge the AI trust gap.

And we have discovered two main drivers of distrust – a lack of detail and a disregard for consumer concerns.

- It’s not clear what AI in finance means

It’s what we’ve already observed across a few other industries. The finance sector falls into the comms trap of talking a lot about AI but little about specific AI-enabled use cases and experiences.

In other words, while many companies are eager to highlight their use of AI, they often fall short of effectively communicating the practical applications and benefits of these AI integrations to their customers.

This is precisely what some commentators call “AI fatigue”: brands blindly jumping on the AI trend without good PR and comms strategies. And it leaves consumers feeling disconnected and sceptical.

2. Finance players don’t address emerging concerns

Among the financial institutions that do talk about specific AI-enabled use cases, very few address the main reason consumers don’t like AI in finance – they don’t trust financial institutions with their data.

Several surveys found that as many as two-thirds of respondents believe using AI in finance increases their exposure to risks like privacy and security breaches.

And this correlates with what the media outlets in our sample highlight as the biggest AI issue – privacy and data protection:

Data leaks are just the tip of the iceberg. The complexities of data anonymisation are also often highlighted, with journalists noting that despite efforts to anonymise data before AI training, generative models may still inadvertently produce identifiable information.

Against this backdrop, almost no finance company has a strong focus on cybersecurity and data protection in their AI comms.

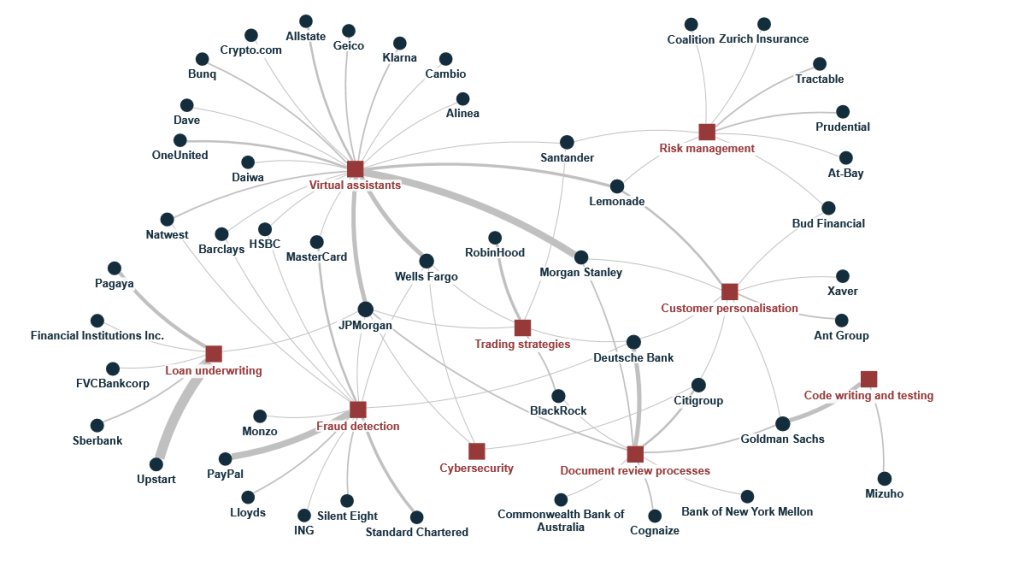

Instead, big banks like Morgan Stanley, JPMorgan and Wells Fargo, insurance companies like Lemonade and Allstate and fintechs like Bunq and Klarna are all eager to talk about their virtual assistants and chatbots.

This is illustrated on the map below, which shows the links between the topics in the media debate (represented by squares) and the companies (represented by circles).

While there are some mentions of Citigroup, JPMorgan and Wells Fargo using AI for cybersecurity, these references pale in comparison to the extensive coverage of AI-driven virtual assistants.

And even though some finance firms like PayPal, Standard Chartered and MasterCard focus on using AI in fraud detection, it is on things like anti-money laundering and unauthorised transactions rather than privacy and data protection.

Our take

The challenge for banks, insurers and credit unions is clear: a significant trust deficit can limit AI’s broader acceptance.

Financial services firms should close this trust gap through consistent, transparent communication about the tangible benefits of AI. Here are a few tips on how this might happen:

- Focus on people, not on tech. Talk about what the financial service does, not how it does it. Talk about what it means, not how advanced it is. For example, promote faster loan approvals, not AI-powered credit scoring models. Promote personalised investment strategies, not AI-based robo-advisors.

- Use data privacy as a differentiating factor. Emphasise the commitment to cybersecurity, data protection and privacy as core components of the financial service, not nice add-ons. Use this focus to differentiate from competitors by making clear that these elements are built into the foundation of the AI services offered, enhancing customer security.

- Go beyond chatbots. As we can see, most financial services firms focus on assistants and chatbots. But mapping the media debate in the way we showcase above allows you to pinpoint areas where there is little to no media coverage, offering white spaces for strategic messaging. In our case study, areas like risk management and trading strategies emerge as two such spaces, in addition to data privacy. This targeted approach ensures that the messaging is both relevant and impactful, addressing gaps in public understanding or awareness while positioning the organisation as a thought leader and a customer-led service provider.