Commetric sees gaps in the media discussion about financial inclusion which are ripe for messaging and storytelling.

The context: Financial inclusion – the availability and equality of opportunities to access financial services – is a major issue around the world. Nearly a billion and a half people living in emerging economies are “unbanked”, as they don’t have access to formal savings and credit.

Millions more people in developed economies are “underbanked”—they may have a bank account but still rely on things such as money orders, cheque-cashing services and payday loans, which are relatively expensive to use compared with credit cards or traditional loans.

Fintechs lead the way

Against this backdrop, more financial services providers are focusing their PR campaigns on financial inclusion.

Our analysis of 714 English-language articles published in the last year showed that fintechs and neobanks, such as Stellar, Strike and Nubank, dominated the discussion, followed by traditional banks like HSBC and Barclays, and payment providers like Mastercard and Visa:

In turn, the media debate was focused on fintechs’ mobile and digitalisation solutions, led by how mobile apps improve financial inclusion and followed by cryptocurrencies and blockchain technology:

In contrast, central bank digital currencies (CBDCs) were not so popular. This form of digital currency issued by a country’s central bank is often a main way that traditional banks champion financial inclusion.

A very limited understanding

The mobile, crypto and CBDC solutions are focused primarily on aiding rural and underdeveloped communities in emerging economies in Asia, Africa and Latin America so the media debate has a pretty one-dimensional view of financial inclusion.

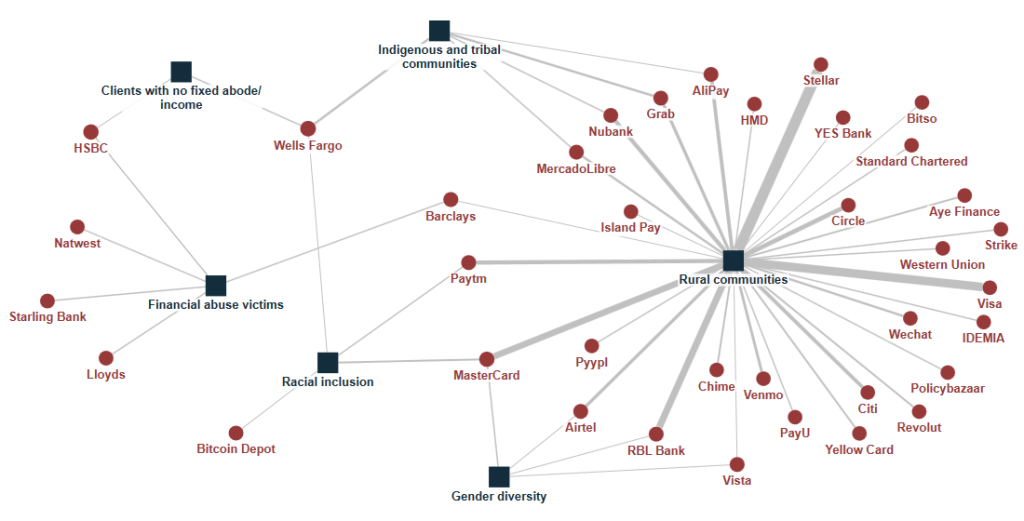

Fintechs, traditional banks and payment providers rarely touched on other financial inclusion issues, such as racial inclusion, LGBTQ+ diversity, or Indigenous and tribal communities, as illustrated on the map below which shows the links between the topics in the media debate (represented by squares) and the companies (represented by circles).

For example, Nubank focused on including unbanked Brazilians and Mexicans in the credit card market, while Stellar partnered with Yellow Card to address the challenges of the banking infrastructure in countries across Africa.

In the meantime, Revolut and Chime shared success stories from Asia Pacific to Latin America and Africa, while Airtel Payments Bank, IDEMIA and HMD partnered to introduce digital currencies on feature phones in India.

The narrative gaps to fill

While financial inclusion stories should be about all unbanked and underbanked communities, we see that in practice this is far from the case. This leaves several white spaces—untapped topics or narratives— which present finance players with valuable opportunities.

By filling this media “white space,” PR and comms teams can bring attention to their organisation’s offerings and contribute to shaping the conversation around the issues of the day. This targeted approach ensures that the messaging is both relevant and impactful, addressing gaps in public understanding or awareness while positioning the organisation as a thought leader.

Here are the white spaces in our case study which can be occupied with the right positioning strategy:

- Racial inclusion: Despite recent campaigns by Mastercard and Wells Fargo, discussions around financial inclusion for racial minorities often miss specific challenges such as Black African and Black Caribbean groups being 4x and 3.5x more likely to be denied a loan compared to white groups in the UK, according to Fair4All Finance.

- Gender and LGBTQ+ diversity: While there have been some gender-related campaigns, like Vista and Stellar‘s recent efforts to empower underbanked women, there is a significant gap in discussions around financial inclusion for LGBTQ+ individuals, who are statistically less likely to have bank accounts, as the recent US LGBTQI+ Economic and Financial (LEAF) Survey found.

- Financial abuse victims: Financial abuse is a form of abuse when one intimate partner has control over the other partner’s finances and affects 99% of domestic violence cases, according to the US National Network to End Domestic Violence. While Natwest, HSBC, Starling and Lloyds gained some visibility on this topic in the UK with new services helping hide a survivor’s location, victims of financial abuse are often excluded from financial inclusion discussions.

- Indigenous and tribal communities: Despite recent efforts by Wells Fargo to shed light on the topic, the financial needs of indigenous and tribal communities – who often face higher banking fees and fewer financial service options, according to the US Joint Economic Committee – are frequently underreported.

- Clients with no fixed abode/income: HSBC was the only finance firm featured in our media sample which offers accounts for people with no fixed abode with its UK No Fixed Address programme. Financial inclusion for homeless individuals or those with unstable incomes is rarely discussed.