LVMH did a good job of reimagining itself for a new mass audience by sponsoring the Olympics, but it should be mindful of emerging reputational risks.

LVMH‘s shift

For the first time, a luxury brand was an Olympic sponsor. And it wasn’t just one brand, it was the empire of LVMH.

If it sounds strange, that’s because mass-appeal sporting events are usually seen as beneath the highest-end luxury companies, even when these events are hosted in their home country, as was the case here.

Historically, brands sponsoring the Olympics primarily sold beer and sneakers rather than luxury goods, with very few exceptions like Omega, which has been the official timekeeper of the Olympics since 1932, and Armani, which supplies uniforms for the Italian teams.

Luxury companies usually target wealthy jet-setting country clubbers through more upper-class sporting events like golf, tennis, polo, sailing and Formula One.

But LVMH invested 150 million euros ($163 million) in the 2024 Olympic Games. This is part of the reason why it emerged as the most talked-about fashion company in our analysis of 1,333 English-language articles published in the last three months around the fashion industry’s role in the Olympics.

It even surpassed traditional sportswear sponsors like Ralph Lauren, adidas and Nike, which count on the Olympics for brand exposure:

This large share of voice wasn’t just because of the newsworthiness of the sponsorship deal – LVMH and its brands were discussed in a variety of contexts, unlike the rest of the fashion companies, which were mentioned primarily for designing sports uniforms.

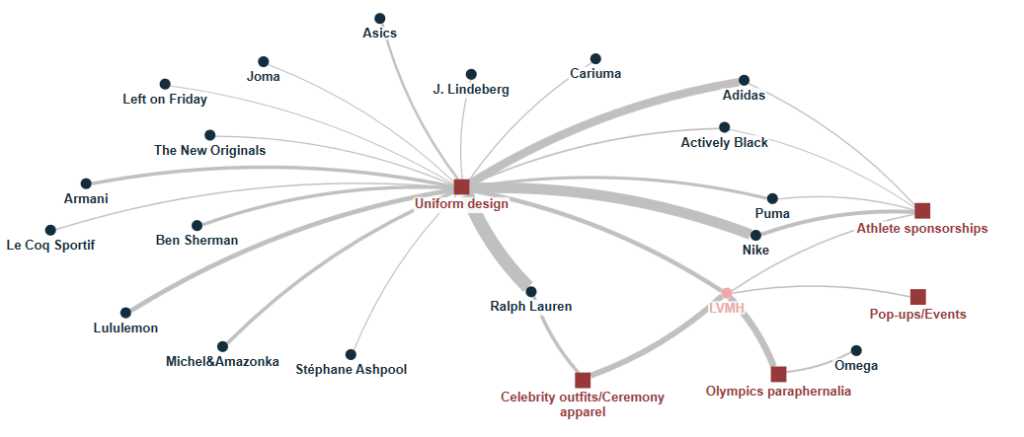

This is illustrated on the map below which shows the links between the topics in the media debate (represented by squares) and the fashion companies (represented by circles).

Some LVMH brands became prominent for designing Olympics paraphernalia – for instance, one of LVMH‘s jewelers, Chaumet, designed the medals, while one of its fashion brands, Berluti, created the uniforms for the French athletes. Moët champagne and Hennessy cognac were prominent in reports of pop-up establishments.

In the meantime, Louis Vuitton was at the centre of the X discussion around LVMH‘s engagement with the Olympics, as we found while utilising Commetric’s blend of AI-powered analytics and human expertise to analyse nearly 5,756 Olympic-related tweets posted in the last six months.

X users largely admired the Louis Vuitton trays used for presenting Olympic medals and Dior‘s intricate and sophisticated design of Céline Dion’s outfit at the opening ceremony.

Positive feedback was also common for Chaumet‘s medal designs, particularly the inclusion of Eiffel Tower metal in the medals, while Berluti received accolades for the stylish and elegant outfits designed for the French team.

Ditching exclusivity

Exclusivity is the central reputation pillar of all luxury brands. The illusion of scarcity and rarity is what drives consumer demand towards luxury goods, even more than quality.

But analysing the X conversation, we found that in this case, exclusivity was the least visible LVMH reputation pillar. Instead, the discussions around things like Louis Vuitton medal trays and Chaumet‘s medals put another, otherwise less prominent LVMH reputation pillar at the forefront – innovative design:

By being everywhere at such a mass-appeal event, LVMH and its brands conveyed a message that goes against every luxury comms strategy – “our products are as accessible as beer and sneakers”.

It seems like LVMH is becoming part of a larger strategic push into mass sports by the world’s top luxury companies.

With the luxury industry in trouble, they realised that a growing share of their business depends on aspirational consumers they can reach through hugely popular events that ditch old-school exclusivity—some 60% of global luxury sales today come from people who spend less than €2,000 a year on luxury goods.

A new strategy means new reputational risks

But this shift in comms strategy brings new reputational pitfalls, which can be different from what LVMH is accustomed to.

Our analysis of the X debate revealed several reputational risks that emerged around the Olympics and that can mean real trouble if LVMH doesn’t take note in future campaigns.

- Over-branding and commercialisation: A number of tweets criticised the heavy commercialisation of the Olympics, with LVMH and its brands’ presence being seen as overwhelming. Users expressed concerns about the event becoming more of an advertisement rather than a celebration of sport.

- Environmental impact and sustainability: Others expressed scepticism about LVMH’s claims of sustainability, especially in the context of the Olympics being marketed as the “most sustainable” games ever. Concerns were raised about the environmental impact of producing luxury goods and the authenticity of the brand’s green initiatives.

- Animal rights and ethical practices: Several tweets highlighted animal rights protests and criticism from organisations like PETA, specifically targeting LVMH’s practices. This includes references to the use of animal products and other ethical concerns associated with luxury fashion.

- Lack of authentic engagement with sports values: Some Twitter users felt LVMH didn’t communicate a genuine commitment to the values and spirit of the Olympics, such as sportsmanship, unity and inclusivity. This perception could lead to criticism that LVMH is merely using events as a marketing platform without truly embracing what the competitions stand for.

- Political and social backlash: Tweets mentioned protests and social movements, such as those against changes in retirement age in France, that targeted LVMH’s headquarters.

The bottom line

Our analysis found that LVMH successfully put its innovative designs at the forefront during the 2024 Paris Olympics, making them appear more accessible to a wider audience. This strategic move effectively showcased the company’s creativity and prowess, resonating well with a broader demographic.

However, this approach has introduced new reputational risks, as it shifts away from the traditional exclusivity that defines luxury brands. By making its products seem more accessible, LVMH now faces challenges in navigating new territory, such as managing perceptions of over-commercialisation and ensuring that the brand’s involvement in mass-market events like the Olympics remains aligned with its luxury image.

These are uncharted waters for a company rooted in exclusivity, and LVMH must carefully balance innovation with the preservation of its luxury identity.