The crisis in Germany’s chemical sector can be an opportunity for companies like BASF and Covestro to reimagine themselves as sustainability pioneers.

The problem

Germany’s chemical industry, one of the most well-established in the world and a cornerstone of the country’s economic prosperity, is in the deepest crisis it has ever faced.

The impact of high costs, weak demand and falling prices has been so big that Financial performance and market challenges was the largest topic by share of voice in the media discussion around five of Germany’s chemical giants – BASF, Covestro, Brenntag, Lanxess and Evonik. This is what we found out analysing 3,581 articles around those companies published in English, German, Italian, Spanish and French during the last 12 months.

However, the poor financial performance of these companies is only the tip of the iceberg when it comes to their reputational challenges.

The Financial performance and market challenges topic has focused on the industry’s heavy reliance on energy, highlighting how its status as a highly energy-intensive sector has made it particularly vulnerable to the worldwide energy crisis.

This is why energy intensive was the most prominent brand attribute across BASF, Covestro, Brenntag, Lanxess and Evonik.

In contrast, the sustainability pioneer brand attribute was among the least visible:

Additionally, traditional chemicals were the focus of media discussions, primarily because these products are deeply integrated into the core operations and revenue streams.

This was at the expense of their sustainable chemical products:

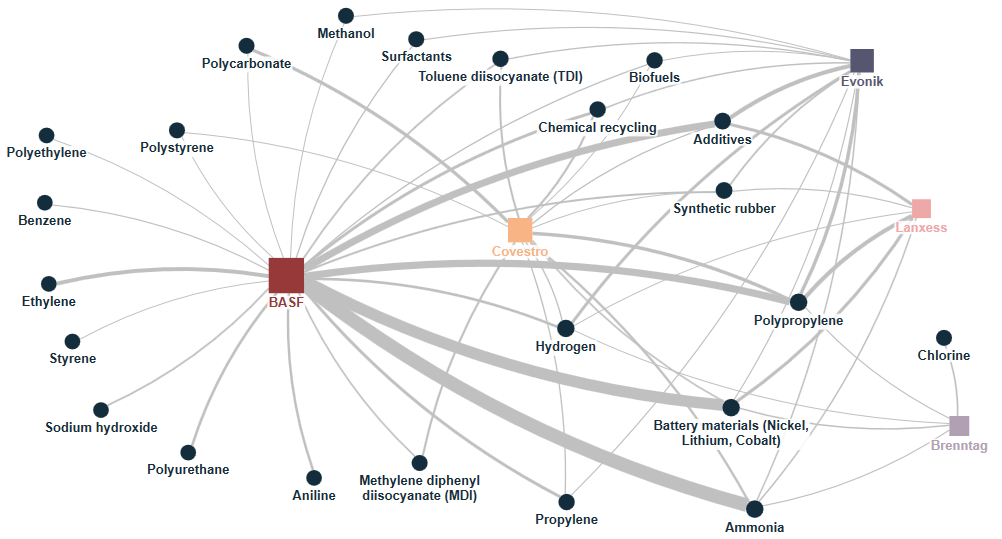

For instance, BASF’s financial struggles were often tied to the performance of chemicals like ammonia and battery materials like nickel, lithium, and cobalt because these inherently unsustainable products are crucial to the company’s core operations and revenue, and their production processes are highly energy-intensive, making them particularly vulnerable to the rising energy costs.

Similarly, traditional chemicals like polypropylene and polycarbonate were among the most discussed Covestro products as they are widely used in sectors like automotive and construction, which have been heavily affected by economic downturns and energy price surges.

This is illustrated on the map below which shows the links between the companies (represented by squares) and the products (represented by circles):

We can see that sustainable chemical solutions, such as hydrogen or biofuels, which are produced with a focus on sustainability and reduced CO₂ emissions through renewable energy sources, were sidelined in media discussions.

This contributed to the negative image of the industry as a major polluter and portrayed it as lagging behind global efforts in sustainability, reinforcing perceptions that it has been slow to adapt to greener practices.

How companies can reposition themselves

As every PR pro knows, a crisis also creates new opportunities.

This crisis should serve as a catalyst for a transformation of Germany’s chemical industry, away from petroleum-based chemistry and the dependence on excessively high energy costs.

Of course, this means deep structural changes. But every structural change requires a new PR strategy. Here’s where to start:

1. Learn what drives the sustainable chemistry debate

To begin with, BASF, Covestro, Brenntag, Lanxess and Evonik should become a more active part of the global media debate around sustainable chemistry by knowing how it unfolds.

For instance, our analysis of 4,536 articles around sustainable chemistry showed that while German companies have been busy justifying their existing business models and value propositions amid the crisis, the sustainable chemistry debate has been driven mainly by research and innovation:

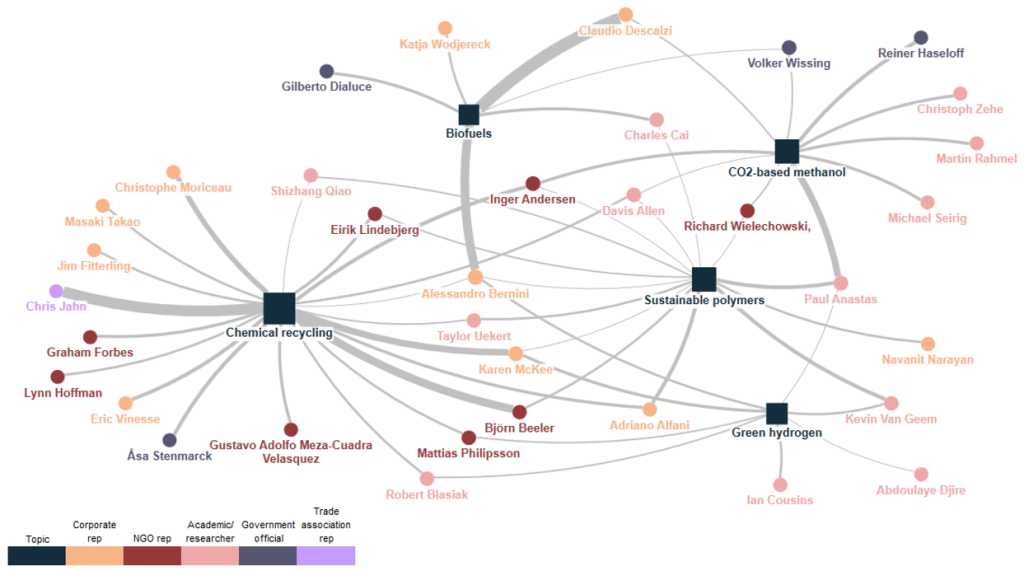

We also found that green hydrogen, chemical recycling, biofuels and sustainable polymers were among the solutions at the forefront of the conversation as they offer practical solutions to reducing waste and decreasing reliance on fossil fuels, aligning with global sustainability goals and the growing demand for environmentally friendly practices.

These are all areas where Germany’s chemical sector excels – it just hasn’t taken the lead in these conversations yet.

2. Know who drives the conversation

Firms in the chemical sector can also amplify their messages in the sustainable chemistry space by pinpointing key opinion leaders, such as Paul Anastas, a professor of chemistry at Yale University, who is a polymers expert, or Chris Jahn, a spokesperson for the International Council of Chemical Associations, who is an authority on chemical recycling, as illustrated on the map below:

Pinpointing key influencers is especially important in chemistry debates because it helps communicate complex products and processes, making them more understandable and appealing to a broader audience.

3. Beware of emerging reputation risks

Chemical companies wanting to break into the sustainable chemistry conversation should closely monitor emerging reputational risks associated with the controversies surrounding the most popular sustainable solutions.

For instance, we found that many articles have suggested that while chemical recycling can handle a broader range of plastic waste, it can also lead to higher greenhouse gas emissions compared to mechanical recycling.

In the meantime, the high energy consumption required for water electrolysis, the predominant method of producing green hydrogen, has raised concerns about whether the process is truly sustainable, especially if the electricity used isn’t entirely sourced from renewables.

The bottom line

The current energy crisis has underscored the German chemical sector’s heavy reliance on energy-intensive processes, revealing vulnerabilities in their traditional business models. However, this challenge presents an opportunity for these companies to reposition themselves as pioneers in sustainability.

By leveraging insights from the ongoing media debate around sustainable chemistry, these companies can pivot towards more sustainable practices and innovation. Embracing sustainable chemistry not only mitigates their energy dependencies but also aligns with growing market and regulatory demands for environmentally friendly solutions, potentially transforming public perception from polluters to leaders in sustainability.