View a one-page infographic summary of the analysis

In the past year, celebrities and social media influencers have been taking diabetes treatments for weight loss, sharing their positive results and generating numerous media headlines.

The result? An amplified media focus on diabetes as a whole.

In this ever-evolving landscape, staying ahead means understanding the undercurrents shaping diabetes media narratives. What are the critical issues influencing public opinion and media debates in this sector? Unraveling these threads is essential for PR and communications professionals working in pharma, and this is precisely where issues landscaping comes into play.

Issues landscaping is a strategic tool designed to delve deep into the what of media conversations – the nuanced sub-issues, conversation clusters, and key stories driving the narrative. At Commetric, we blend advanced machine learning with expert analysis to uncover the insights that matter, offering a granular view that goes beyond the surface. This approach is crucial not only for campaign planning but also for understanding shifts in narrative and public perception.

In this case study, we’ll dive into three key issues identified in the diabetes drug market: drug shortages, pricing dynamics, and the rising tide of competition from medtech and biotech sectors. These topics illustrate the complex challenges and opportunities facing comms professionals in this field, highlighting the need for a data-driven, insightful approach to communications.

Our media analysis of 835 English-language articles published since the beginning of the year revealed that this new media spotlight on diabetes has created a range of reputational challenges for healthcare companies specialising in this area.

1. Drug shortages

The media conversation around diabetes has been significantly dominated by the topic of drug shortages:

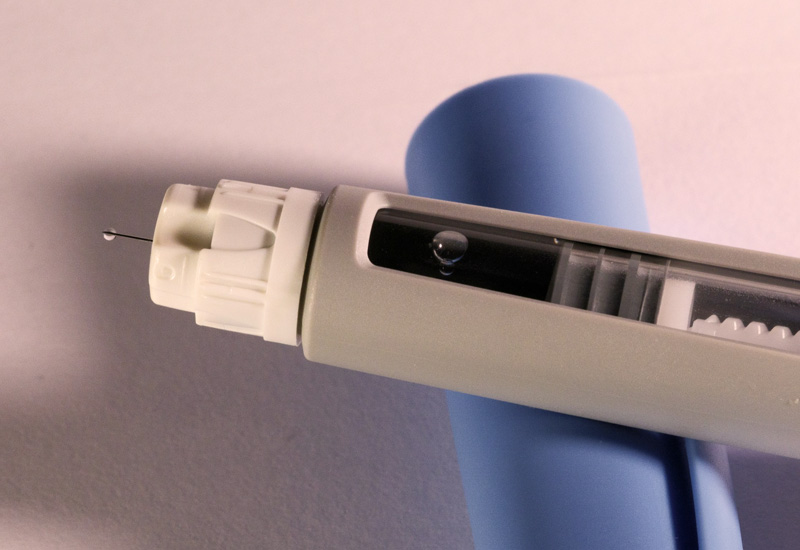

The debate was particularly focused on Eli Lilly’s Mounjaro, and Novo Nordisk’s Ozempic and Wegovy, which have seen a surge in demand due to their use for weight loss, leading to supply shortages and leaving many diabetes patients struggling to access the medications they need for their condition.

Many media outlets suggested that pharmaceutical companies may be marketing these drugs too aggressively to capitalise on the trend.

Some commentators criticised Eli Lilly‘s massive consumer campaign for Mounjaro, which even included a Super Bowl ad, while others pointed out the fact Novo Nordisk donated £21.7 million to health organisations and professionals who in some cases went on to praise their treatments without always making clear their links to the firm.

The ongoing media scrutiny immensely strengthened the already popular narrative portraying Big Pharma as an industry which prioritises profit over consumer well-being.

2. Pricing

Insulin has become a symbol of the challenges within the healthcare system, particularly highlighting issues around drug pricing and accessibility. Over the past two decades, the list prices for insulin have soared, quintupling to over $300 for a single vial, leading to public outcry and intense scrutiny of the pharmaceutical industry.

However, the most recent media debate focused on how the major insulin makers – Novo Nordisk, Eli Lilly and Sanofi – each cut their prices by more than 70%, which made them the most influential companies in the debate:

While welcomed by many, the price cuts have been met with skepticism in numerous media reports suggesting strategic self-interest rather than altruism and genuine care for patients.

Many publications argued that government regulations, notably the American Rescue Plan of 2021 and the Inflation Reduction Act of 2022, will make it costlier for manufacturers to maintain their high insulin prices – and, as the cuts will kick in just as a federal cap on Medicaid payments is eliminated, the lower prices will actually save Big Pharma money.

Moreover, as the price cuts came after years of escalating public backlash, pharma companies were portrayed in many publications as having a reactive rather than proactive stance on pricing strategies.

3. Increased competition from medtech and biotech

As the diabetes market is rapidly evolving, companies within this space are finding themselves in an increasingly competitive environment. This is especially true for the developments in innovative areas like diabetes tech.

For instance, our analysis found that closed loop systems, sometimes called artificial pancreas systems, were the most talked-about innovation, as the most influential spokesperson in the media debate, Partha Kar, National Specialty Adviser for Diabetes at NHS England, was widely cited as saying that closed-loop technology can have a “huge” impact on patients’ quality of life.

The media attention on closed loop systems brought to the fore some less-known medtech companies like Medtronic, Dexcom and Tandem. Another significant development in diabetes tech that gained traction was start-up Bigfoot Biomedical‘s acquisition of a new algorithm designed to analyse how individuals with diabetes respond to treatments.

Apart from diabetes tech, a new frontier in diabetes treatment garnering attention has been gene editing. The first cellular diabetes therapy approved in the US made many headlines and sparked media interest in developments in this area – for instance, biotech Vertex Pharmaceuticals was recently in the spotlight for its collaboration with CRISPR Therapeutics to develop hypoimmune cell therapies.

These evolving narratives around breakthrough therapeutic advances signal a shift towards a more competitive media market, potentially moving from being dominated by a few pharmaceutical giants to a diverse landscape with emerging players from the medtech and biotech sectors.

This transformation presents a significant challenge for PR and communications professionals, who must stay abreast of rapid advancements and have a comprehensive understanding of the competitive environment to effectively navigate their reputation.