- As alcohol consumption is going out of fashion for health-conscious young consumers, RTDs like canned cocktails and hard seltzers are becoming the fastest-growing category in the beverage business, with brands positioning them as better-for-you products.

- Our analysis found that Diageo and Anheuser-Busch were the corporate brands with the biggest impact on the media debate, while product brands such as White Claw, Smirnoff and Jim Beam emerged as most prominent.

- We suggest that media analytics could help PR teams reach their target RTD audience of millennials by tracing how the health and wellness debate evolves, reimagining their brands as part of the solution in terms of alcohol moderation and identifying the white spaces in the yet underexploited sustainability debate.

Almost every media discussion around alcohol-related topics starts with the fact that alcohol is going out of fashion for young generations. The decline in consumption has been in line with developments in other segments of the food and drink industry which have been influenced by the growing popularity of the health and wellness megatrend – good examples that we’ve recently analysed are the meat substitutes market and the plant-based beverages market.

However, there is one recent trend in the food and drink sector that is increasingly viewed as the saviour of the global alcohol beverages industry: the ready-to-drink (RTD) category. Predominantly focused on the younger market, RTD has undergone a resurgence, with diverse new product developments and carefully styled packaging. In fact, it has been the fastest-growing category in the beverage business.

The story of RTDs started in the 1990s and early 2000s, when they were marketed as suitable for partying. However, they are now positioned as better-for-you, craft, premium, and offering a sophisticated array of flavour profiles, with a focus on natural ingredients, canned formats, and Instagram-friendly brand identities.

In public relations terms, this is a nice illustration of the importance of positioning – the place that a certain product occupies in the minds of the consumers. Whether to position a product as great for going out and staying late or as part of a healthy lifestyle (two things that often are mutually exclusive) can make all the difference.

But RTDs are now positioned not only to resonate with consumers’ ever more health-focused lifestyles and their increased demand for low- or no-alcohol drinks but to actually inspire them to be even more health-conscious. And the numbers tell the rest: as per the latest report of IWSR Drinks Market Analysis, total beverage alcohol consumption in the United States improved 2% in 2020, marking the largest volume gain since 2002, with the RTD category recorded growing 62.3%. The category has already outpaced the spirits volume and is likely to surpass wine by the end of 2021.

Cans on the rise

To see how the RTD trend is unfolding in the media, we analysed 595 English-language articles published between March-August 2021.

Our media list included top mass media outlets like Reuters, the New York Times, Forbes and the Guardian, as well as leading industry publications such as The Spirits Business, Beverage Dynamics, Beverage Daily, BBC Good Food and Food & Beverage Magazine.

We found that canned cocktails were dominating the RTD media conversation:

Many publications noted that RTD cocktails are the fastest-growing alcohol beverage category in the US market, especially during lockdowns: Covid-affected period saw an increase of 86.8% year-over-year growth for all RTD cocktails, opposed to 21.5% pre-Covid.

Some journalists attributed the rise in popularity of bar-like RTD cocktails canned packaging to the vibrant and creative packaging, which is particularly attractive for social media-savvy millennials. Another factor has been the dissipating stigma that canned cocktails are low-grade or party drinks – brands have invested in campaigns that specifically framed canned cocktails as something premium.

In a way, the canned cocktail narrative arch from casual to premium is the opposite of the recent narrative arch that wine experienced when sold in can formats. While wine is a product often associated with snobbery, elitism, and even pretension, companies tapping into the new canned trend are hoping to position wine closer to the accessibility of more casually consumed drinks like beer.

According to many commentators, the growth of canned cocktails was particularly fueled by the rising popularity of hard seltzers (flavoured sparkling water infused with alcohol), the second most commonly discussed topic in the RTD debate. Experts noted that seltzers have been vital to the boom in RTD sales as they’re seen as a lighter alternative to beer in particular – some even call them “the new light beer”.

Many publications remarked that beer’s leading position in the US beverage market seems to be under threat as sales are declining and the number of new breweries is starting to plateau. For a growing number of consumers, the beer offered by industry giants is now something stale in comparison to a can of hard seltzer, which is usually low in calories, has a low sugar content that ranges from zero to four grams and often is gluten-free.

A smaller proportion of the RTD debate was dedicated to hard coffee, which has catered to consumers looking for caffeine-enhanced beverages that offer an additional buzz, as well as for those looking for convenient alternatives to popular coffee drinks such as the Espresso Martini.

However, the emergence of the hard tea category was again an answer to a more health-conscious demand: a number of health-boosting ingredients such as turmeric, ginger, and berry botanicals are being added to tea to offer a well-being halo to consumers. Though alcoholic drinks cannot market themselves as ‘healthy’, these products benefit from their association with health-giving ingredients.

Some RTD reports also highlighted that hard kombucha has been on an upward trajectory over the past decade, transforming from a niche product on the natural channel to a well-known favourite, fuelled by the desire for probiotics. Kombucha brands are aimed at the organic and non-GMO markets, marketing themselves as naturally low-carb, low in sugar and gluten-free.

Diageo and Anheuser-Busch as top corporate brands

We used Commetric’s proprietary ‘media conversation impact score‘ metric to identify the corporate brands with the biggest impact on the media discussion around RTDs.

We determine an organisation’s media impact in the context of a topic by looking at its media influence score calculated in terms of coverage by high-profile media outlets, topic relevancy score measuring its contextual relevance, and media visibility as measured by the number of mentions.

Diageo and Anheuser-Busch, the two giants that emerge as key players within the category, have also had the biggest impact on the debate, as their massive PR budgets secured them coverage in both mainstream and industry publications.

Diageo hit many headlines when it said it would spend $80 million to install two new lines at a plant in Illinois to boost production of ready-to-drink beverages. The new facility will make more than 25 million cases of ready-to-drink beverages every year, including Smirnoff seltzers and spirits-based cocktails from Crown Royal and Ketel One Botanicals.

The company said that RTDs has been its fastest-growing category in North America during the COVID-19 pandemic. Apart from its production investment, Diageo was also in the news for acquiring start-up Far West Spirits, owner of the Lone River Ranch Water hard selzter brand.

Similarly, rival Anheuser-Busch featured in many media reports for announcing a more than $1 billion investment in its US manufacturing facilities to increase the production of hard seltzer. Anheuser-Busch is still perceived to be the king of beers, controlling 41% of the market, but hard seltzer is its big focus right now. A venture which attracted much media attention in the past was the launch of its Bud Light Seltzer.

In addition to seltzers, AB InBev earned its media prominence by promoting its investment in the RTD cocktail company Canteen Spirits. The news came shortly after Canteen Spirits secured $31 million in funding to boost its US expansion and open a new facility.

Meanwhile, Beam Suntory was mentioned for expanding its Jim Beam offering in the US with the addition of two new ready-to-drink cocktails featuring a bourbon base, inspired by the highball cocktail. Beam Suntory also entered into a partnership with The Boston Beer Company to launch products that expand Beam Suntory‘s Sauza tequila brand further into the RTD beverages category and Boston Beer‘s Truly Hard Seltzer into bottled spirits.

Perhaps surprisingly, soft drinks giant Coca–Cola was also a considerable part of the conversation, as its Topo Chico Hard Seltzer launched in Latin America in September, rolled out to European markets in November and the US this year via a partnership with Molson Coors. Commentators noted that Coca–Cola has come into the hard seltzer category far later than US pioneer brands, but its global reach means it has been able to take its product and propel it across the globe and explore new markets at a speedy pace.

As this was Coca–Cola’s first global push into alcohol, some journalists asked themselves whether we can expect more alcohol launches from the soft drinks giant to follow. Others noted that the RTD investment by one of the best-known soft drink companies in the world, the spiked sparkling water category has stopped being a trend and became a permanent market.

Soft drink rival PepsiCo didn’t fall behind, although it had less of an influence on the media conversation. It was primarily mentioned for its collaboration with Boston Beer, which resulted in the development of a hard seltzer product called Hard Mtn Dew.

Meanwhile, Bacardi obtained its media influence by expanding its Bombay Sapphire portfolio with the addition of two new RTD gin and tonic offerings, following the launch of a canned Bombay Sapphire gin and tonic last year.

But the RTD discussion didn’t feature only industry giants. For instance, one of America’s earliest craft distilleries, Dogfish Head, was mentioned for the launch of its scratch-made, ready-to-drink canned cocktails. The distillery’s lineup of RTDs attracted media attention with its “off-centred” recipes, including Blueberry Shrub Vodka Soda, Strawberry & Honeyberry Vodka Lemonade and Cherry Bergamot Whiskey Sour.

Among all the news about investments by industry giants, Australian start-up Curatif was perceived as leading the canned cocktail revolution. In April, the company hit headlines by taking six medals at the 2021 World Premix Awards, winning World’s Best Classic Cocktail for its Tequila Tromba Margarita and World’s Best Contemporary Cocktail for its Black Pearl Toreador. Last month, it announced a $2.5million investment deal, with funding secured from a consortium of private investors

Mapping the product brands

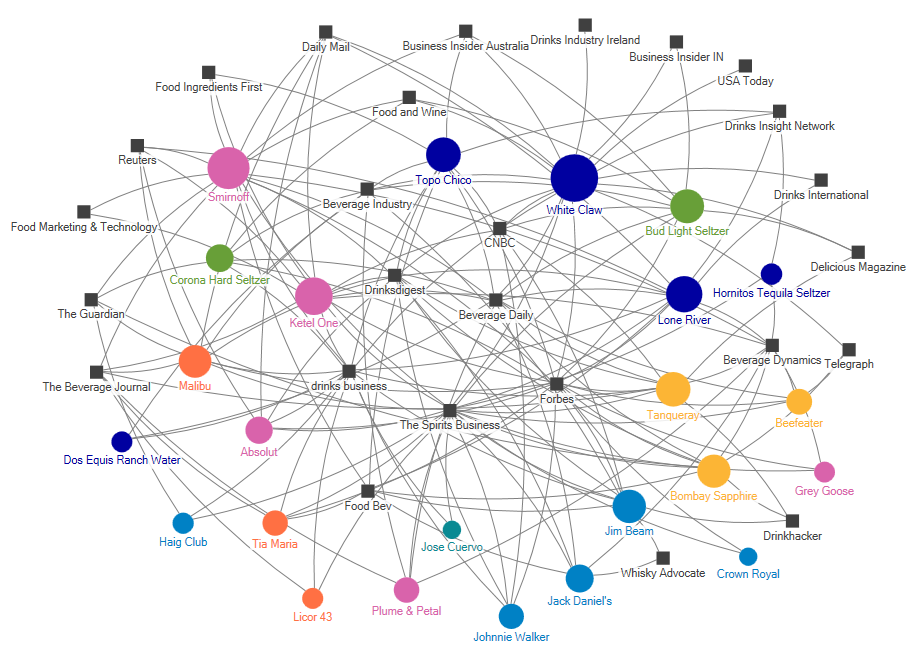

We employed Influencer Network Analysis, our patented methodology that uses natural language processing (NLP), text mining, dynamic visualisation and human enrichment, to analyse the recent media discussion around RTDs and the product brands under the spotlight.

The media discussion around the relevant product brands is presented as a two-mode network map (see below), displaying the brands (circles) and the publications (squares) that referenced them in the RTD coverage. The size of the circles is indicative of the influence that the respective brand is exercising on the discussion.

We colour-coded the brands based on their alcohol types. We used dark blue for dedicated hard seltzer brands like Mark Anthony Group’s White Claw and Coca-Cola’s Topo Chico, pink for vodka brands like Pernod Ricard’s Absolut and Diageo’s Smirnoff, light blue for whiskey brands like Beam Suntory’s Jim Beam and Diageo’s Johnny Walker, yellow for gin brands like Bacardi’s Bombay Sapphire and Pernod Ricard’s Beefeater, green for beer brands like Anheuser-Busch’s Corona and Bud Light, and orange for rum brands like Pernod Ricard’s Malibu.

We found that the industry publications which paid the most attention to the RTD trend included Beverage Daily, The Spirits Business, Drinks Digest and Drinks Business, while the most active mass outlets in the sphere included CNBC and Forbes.

It’s interesting to trace how product brands performed in the discussion as opposed to corporate brands, as PR teams are usually focused on promoting the former rather than the latter. Usually, much of the media coverage around product brands is a result of proactive PR efforts, while corporate brands often feature in business-related reports and analyses of current sector trends.

For example, although its corporate brand Mark Anthony Group didn’t perform that well, we found that White Claw was the most influential product brand in the debate, obscuring legacy beverage brands that are trying to have their slice of the pie.

Mass publications such as Business Insider, CNBC and Forbes wrote that since its creation in 2016, White Claw has become one of the most successful brands in the world. And industry publications like Drinks Insight and Beverage Daily remarked that not only has the brand pioneered a new drinks category, hard seltzers, but it has also developed a brand strategy that listens carefully to its consumers and their needs – for example, it updated its original recipe to reduce calories and sugar content.

Many outlets also noted that White Claw has been enjoying a first-mover advantage and by targeting millennials via social media videos and viral memes. Recent news reported that the brand is poised to launch a global ad campaign called “Let’s White Claw” as it plans to launch in 10 new markets in 2021. The ad campaign, done with Accenture agency Rothco, will mark the company’s first global campaign and “by far” its biggest, chief marketing officer John Shea told CNBC.

Diageo’s vodka brands Smirnoff and Ketel One were featured in industry publications like Drinks Business and The Spirits Business as Diageo announced it would spend $80 million to boost their RTD versions.

Another vodka brand, Pernod Ricard’s Absolut, turns to RTD innovation for growth, as Fredrik Syrén, its director of global channel marketing, said RTD innovation has become a key consideration. “The market has exploded in several parts of the world in the last couple of years,” he told Drinks Digest. “Much of this development stems from a strong US-based trend which can be summarised as “better for me”. Meanwhile, Pernod Ricard’s Malibu was the most impactful rum brand, as it announced new RTD Pina Colada cocktails.

Diageo’s whiskey brands Crown Royal and Haig Club, as well as its gin brand Tanqueray, were also noticed by industry outlets for their new RDT offerings. Diageo’s most influential brand was Johnny Walker, which attracted media attention as it added its first-ever RTDs to the mix with the Johnnie & Blood Orange Highball and the Johnnie & Lemon Highball.

However, the most prominent whiskey brand in the discussion as a whole was Beam Suntory’s Jim Beam, which tapped into the demand for tins as it unveiled two new whiskey-based canned cocktails, a Jim Beam Classic Highball and Jim Beam Ginger Highball.

Jim Beam was followed by Brown-Forman’s Jack Daniel’s, which introduced an RTD range in Australia taking cues from classic cocktails: Zesty Lemon inspired by The Whiskey Sour and Blood Orange inspired by The Old Fashioned.

The most impactful gin brand was Bacardi’s Bombay Sapphire, which expanded its RTD portfolio with two new expressions: Bombay Bramble and Tonic, and BombaySapphire and Light Tonic. The new RTDs will join the brand’s signature Bombay Sapphire and Tonic.

RTD opinion leaders

Corporate spokespeople emerged as the top opinion leaders in the RTD media discussion, as we analysed the key individuals by influence score (calculated in terms of coverage by high-profile media outlets).

Diageo North America President DebraCrew was the most influential spokesperson, commenting on Diageo’s substantial investment in RTD production, saying that as the ready-to-drink category continues to grow rapidly in the United States, this expansion will support the company’s plans to meet increased consumer demand in line with emerging trends for convenient formats.

Another prominent Diageo spokesperson in the conversation was Perry Jones, president of North America Supply for the company, who was cited as saying that the strategic location of the new production site will allow Diageo to create synergies and flexibility to expand and carry other market-leading brands in the future.

The second most influential spokesperson, Dave Burwick, Boston Beer’s CEO, was quoted in reports about his company’s collaboration with PepsiCo, saying that adult drinkers’ tastes are evolving, and they are looking for new and exciting flavorful beverages.

In a similar manner, Beam president and CEO Albert Baladi commented on his company’s partnership with Boston, saying that the two firms tap opportunities in adjacent categories by unleashing shared creativity and respective distribution strengths in spaces that resonate with consumers.

In the meantime, Lone River Ranch Water founder Katie Beal Brown said that she started Lone River with the dream of giving people a taste of Far West Texas. Similarly, Kyle Cooke, the founder of sparkling hard tea brand Loverboy, said he sought a flavour profile that provides an alternative to hard seltzer and to outpace other “healthy” options.

Sam Calagione, Dogfish Head founder, was quoted for his statement that many people don’t know that his company has been distilling spirits for about two decades, and actually released its first ready-to-drink bottled cocktail back in 2017.

And Melkon Khosrovian of LA’s Greenbar Distillery sees canned cocktails not only as an extension of the craft cocktail movement but its future: “In five years, we’ll see shelves that currently hold bottles of beer, wine and liquor filled to the brim with cocktails,” he told Wine & Spirits Magazine.

Although White Claw was the most impactful brand in the discussion, its CEO Davin Nugent wasn’t that often quoted. However, he spoke about the market more generally, noting that consumers are seeking ‘better for you’ options to suit their active lifestyles and they have become less interested in beer and sugary drinks, with their associated high calorie and carb content.

How media analytics can help brands capitalise on the RTD trend

The companies in our research sample strived to address the trends set by millennials and Gen Z in one way or another. As these generations are expected to be the biggest food and beverage spenders in 10 years, with their purchasing power projected to reach $1.4 trillion, the change in consumer tastes is bound to continue.

Based on our analysis, here are a few ways media analytics could help PR teams reach their target RTD audience of millennials and Gen Z:

- Trace how the health and wellness debate evolves. Health quite naturally moved into the spotlight for many consumers amid the Covid pandemic. Boosting the immune system quickly became a priority and, because people ended up cooking more at home during lockdowns, mindful eating has gained traction. As a result, products labelled “organic” are in high demand, prompted by a growing interest in the emerging field of functional products positioned to boost immunity, help relax, aid sleep and improve mood in general. Brands are tapping into the consumers’ perception of the “naturalness” of food and drinks, which has evolved from a focus on sanitation to added ingredients like preservatives, flavours and sweeteners. The ever-increasing health awareness among consumers, coupled with the rise of the organic food industry, has put the notion of “naturalness” at the centre of many debates around the food and drink industry. Even fast-food company McDonald’s hit many headlines when it announced it would introduce plant-based burgers, chicken substitutes and breakfast sandwiches.

- Position yourself as part of the solution in terms of moderation. Alcohol companies sometimes face very similar reputational like tobacco companies. That’s why some parallels in terms of reputation management might help. As we saw in our recent analysis, Big Tobacco continuously aims to reposition itself as an innovative, tech-savvy champion of quitting and youth tobacco prevention. The most successful example in our sample was Philip Morris, which was covered in a positive light for its efforts to reimagine itself as a broader healthcare and wellness company. Working alongside public health and adopting the rhetoric of harm reduction could present companies as problem-solvers for long-term smokers unable to quit. Similarly, RTDs might help alcohol companies reimagine themselves as innovative champions of moderate consumption.

- Identify white spaces in the sustainability debate. Apart from personal health, consumers are increasingly motivated by environmental concerns. Yet, as we saw in our current analysis, RTD brands have focused primarily on health. It’s worth noting that millennials are loving the sustainability angles of consuming canned drinks. Cans are a greener option since they’re recycled more than glass – people recycle their cans 20% more often than they recycle glass, while the proportion of bottles that end up being reused is woefully low. In addition to being more likely to be recycled, aluminium takes less cardboard to hold and weighs less to transport, which cuts down on carbon emissions. Furthermore, cans are made with much more recycled content than glass bottles: according to The Aluminum Association, cans are typically made with 70% recycled materials.