Before COVID-19, the financial services industry was experiencing an unprecedented period of growth and prosperity. Despite increasing consumer expectations and the market disruption and competition from fintech players, most banks were stronger than at any period since the financial crisis of 2008.

In a matter of only a few weeks, the world of banking has experienced a level of disruption that will probably change everything that had been the norm in financial services. There will not only be a major change in the way financial institutions conduct business, but in the way employees do their work and the way consumers manage their finances.

We decided to use the Commetric COVID-19 Business Impact Tracker to analyse the effects of the COVID-19 crisis on the financial services industry. Our free tool uses rule-based natural language processing (NLP) and machine learning to track more than 450 types of news-reported business events that affect companies and industries during the pandemic.

We analysed 79,403 articles from 6,375 online media outlets for the period 1 Mar- 20 April 2020, covering most publicly-traded companies in the US, and looked into the financial services business drivers that gained the most traction in the media in the context of the COVID-19 pandemic.

Unlike most industry sectors, where the most prominent news-reported driver was Financial Performance, the COVID-19 media coverage around the financial services industry was dominated by news about Corporate Governance and CSR. Specifically, around a quarter of the reporting talked about the change to a virtual-only format for Annual Shareholder Meetings.

In terms of CSR, it is interesting to note that according to the COVID-19 Business Impact Tracker, out of all sectors, the financial services sector achieved the greatest media resonance in relation to its donations to support various COVID-19 initiatives.

Thus, HSBC donated £1 million to the National Emergencies Trust Coronavirus Appeal and British Red Cross in support of vulnerable people, and Wells Fargo announced a $6.25 million donation to support domestic and global response to the coronavirus and to help public health relief efforts.

Financial Performance was the second most prominent business driver for the financial sector in the media. In this regard, most big banks announced deteriorated financial results caused by the COVID-19 crisis.

For example, JPMorgan and Bank of America announced that first-quarter profit tumbled by 69% and 45% respectively, as credit costs surged, and Morgan Stanley, the smallest of the six major U.S. banks with few true peers in the bunch, which had left some investors unsure how it will fare in a coronavirus downturn, reported a 30% slump in profits.

Another important financial services driver reported by the media was Labour. In this regard, several banks, such as Morgan Stanley, Citi, and HSBC, pledged to preserve jobs amid the widespread impact of the coronavirus.

There were banks, however, which announced plans to hire more people to meet the increased demand for certain services. Thus, in March 2020, Bank of America hired more than 1,700 people in its consumer banking division as it faced a surge in customer service demand amid coronavirus concerns.

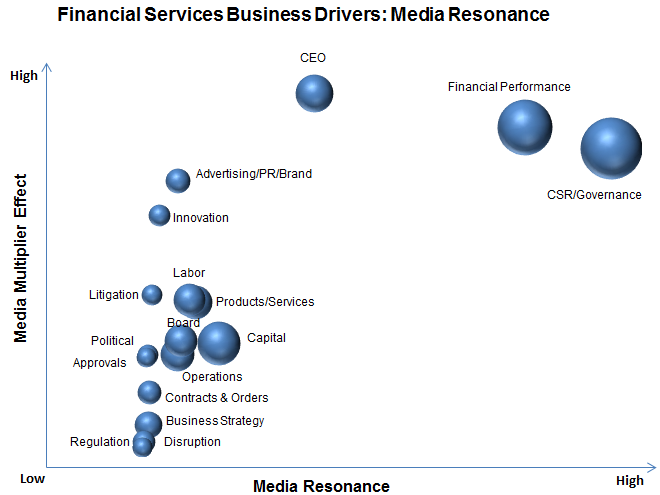

With regards to PR and communications management, it is interesting to see which financial services business drivers attracted the most interest by the media, something we call ‘media resonance’, and the extent to which the news about these business drivers was amplified by the media, i.e. the media multiplier effect.

Such analysis is presented on the chart below, where media resonance indicates the volume of reporting around a given business driver for all financial services companies monitored, and the media multiplier effect was calculated by dividing the amount of coverage for a given driver by the number of companies implicated, represented by the size of the bubbles on the chart.

The CEO driver ranks the highest in terms of media multiplier effect, i.e. news containing statements by the CEO or just mentioning the CEO seems to be covered by more media outlets. This has important implications for the corporate reputation of financial services companies, as CEOs play an integral role in the reputational evaluation of their firms, and media coverage of CEOs can thus increase their prominence and affect perceptions of their quality.

Notable examples are the statements by JPMorgan’s CEO Jamie Dimon, who said that JPMorgan is in strong financial condition to make it through the tough time, and Morgan Stanley’s CEO James Gorman, who sees much less of a physical footprint in its future.

Innovation and Advertising/PR/Brand are other important business drivers that serve to differentiate financial services businesses in the eyes of consumers. Unfortunately, the news about financial services innovation in the context of COVID-19 was related mainly to launches of amended banking products designed to better serve the needs of customers affected by the crisis.

The news about the Advertising/PR/Brand driver covered mainly the cancellation of annual events or conferences held by big banks as part of their thought leadership strategies.

Finally, a good example of how to communicate in times of crisis was provided by Banco Bilbao Vizcaya Argentaria (BBVA), which launched a brand campaign under the hashtag #IStayAtHome, aiming to encourage US customers to stay home and stay safe by conducting their banking transactions using the bank’s phone and digital channels.