- Digital-only banks are increasingly under the media spotlight, as they try to capitalise on the limitations of traditional banking and the negative reputation of legacy finance brands.

- The recent media debate around neobanking featured big tech players like Google and Amazon, Wall Street giants like Goldman Sachs and JPMorgan, and many start-ups, such as Revolut, Monzo and Starling.

- Anne Boden, CEO of Starling, was the top influencer in the traditional media debate, while venture capitalist and futurist Spiros Margaris was the most influential individual on social media.

From retail and telecommunications to construction and transport, numerous sectors have experienced a full-on digital transformation and disruption. However, one particular sector has been rather resistant to the dynamics of the all-encompassing digitalisation: financial services. Analysts have usually attributed this to the ever-tightening regulations which are hampering innovation and the focus on repairing balance sheets and cutting costs since the financial crisis.

But this is about to change with the rise of mobile banking in the US and Europe, and digital payments in China and other parts of Asia – services which the media has increasingly started to dub “neobanking“, a type of direct banking that operates exclusively online without traditional physical branches.

As the Economist put it, the future of banking could be best understood through the eyes of digital natives. The main reason people choose a bank is convenience – for older people that means a nearby branch, while for younger ones it means an excellent app.

A story of disruption

We analysed 608 articles published between November 2020 – May 2021 in top-tier English-language outlets and found that Market disruption was the largest topic in the discussion around neobanking:

Articles within the Market disruption topic focused on how the new wave of neobanks entering the market has challenged every part of the traditional banking model by working on a narrow use case or product. Challenger banks capitalised on the limitations of traditional banking and the negative perception of the industry facilitated by the post-2008 distrust in major banking institutions.

While the rapid growth has been predominantly in the retail market, many neobanks including Starling, Tide, Revolut and, more recently, Monzo have launched business current accounts. Starling, for example, was one of the banks chosen by the British Business Bank to offer Coronavirus Business Interruption Loans (CBILs) during the pandemic.

Mainstream banks have argued that customers appreciate the security and human interaction of high street banks. Big players have usually relied on their established brands, but their legacy back-office structures and high regulatory standards have left them scrambling to keep up with the emerging fintech trends. Feeling the urgent need for innovation, many are looking for new ways to keep pace with the myriad of tech-based challengers.

Of course, the financial world has been subject to digitalisation since the advent of computers, but the reason for the current rush has been the market disruption caused by the booming fintech scene and neobanking in particular. As 85% of millennials bank on their phones, “becoming a digital business” has become a top priority for financial services CIOs, as a recent Gartner research concluded. Their digital enthusiasm is far greater than the average across other industries and beats other objectives such as profit growth and consumer satisfaction.

The Covid impact topic concentrated on how the neobanks have been amongst the many business models that flourished during the pandemic, as the crisis catalysed the digital transformation of various industries. The coronavirus has forced some traditional branches to close permanently, and prompted many people to get used to digital services in all areas of life.

However, reports on neobanks weren’t exclusively positive – the global economic turmoil forced Britain’s three largest digital banks Revolut, Monzo and Starling to cut costs and rapidly find new income streams.

Last April, revenues at Revolut and Monzo both dropped by around 40%, as card transaction fees, particularly from foreign travel, decreased. When reporting on such stories, some journalists noted that neobanks have been lossmaking for years and now are under heightened pressure to prove their businesses can make profit.

Revolut, for example, made a “big shift” from foreign exchange (traditionally its most popular offering) to other revenue streams, such as cryptocurrencies and more regular domestic spending. Such developments made Cryptocurrencies a major topic in the debate as well, with commentators noting that 2020 saw the rise of crypto challengers and this trend has continued into 2021.

Some neobanks have launched specifically with the mission to capitalise on the crypto boom – for instance, Ziglu launched in the UK with the core focus to provide a seamless way for consumers to buy cryptocurrencies. But not all neobanks followed the trend – unlike Starling and Revolut, Monzo said that his company had focused on “sustainable” revenue streams.

As neobanking and cryptocurrencies are still relatively new, Regulation was also an important topic in the conversation. Some of the industry’s most senior executives have warned that tighter UK rules for fintech groups will make it harder for start-ups to get off the ground and threaten the sustainability of smaller companies, as the Financial Conduct Authority is planning to enforce new rules to protect consumers that experts say will drive up costs in an already low-margin sector.

As with many tech-related developments, Cybersecurity was also a big topic, with experts asserting that bigger banks still currently have the advantage when it comes to resilience, as the new players try and meet the cyber security defences of the incumbents with only a fraction of the budget.

Big tech and big banks vs small start-ups

We used Commetric’s proprietary ‘media conversation impact score‘ metric to identify the organisations with the biggest impact on the media discussion around the neobanking sector.

We determine an organisation’s media impact in the context of a topic by looking at its media influence score calculated in terms of coverage by high-profile media outlets, topic relevancy score measuring its contextual relevance, and media visibility as measured by the number of mentions.

We found that the most impactful organisations in the discussion were three types: big tech companies, legacy banking brands and start-ups. But while start-ups were quantitatively more, the most influential organisation in the debate was actually a big tech company – Google:

Google dominated the conversation due to its revamped strategy towards banking with a new style of mobile bank account. Google Pay, which used on only about 4 per cent of the 2.5bn Android devices around the world, will now be a conduit for Google to serve up personalised offers from merchant, with Citibank and 10 other banks and credit unions in the US.

Journalists remarked that Apple’s groundbreaking credit card with Goldman Sachs has become the model for arrangements like this, as well as a strong motivator for other financial institutions to get off the sidelines and find a way to work with Big Tech. According to many articles, Google’s would be the first regular Big Tech checking account, though almost certainly not the last.

Another big tech player, Amazon, was featured because its partnership model was perceived to pose real threats to traditional banking providers although the retail giant doesn’t yet have plans to launch a bank of its own. Some commentators suggested that retail banks and credit unions face the same fate as brick-and-mortar retailers like Borders and Barnes & Noble if they don’t play Amazon’s game.

The second most influential organisation was a legacy banking brand – Goldman Sachs. It hit headlines for investing $69 million in Starling, one of the U.K.’s biggest neobanks, which tried to differentiate from rivals like Revolut and Monzo with a focus on small business banking.

Goldman’s investment in the company comes after reports that JPMorgan and Barclays had shown an interest in buying Starling, though the neobank has denied this. These developments were taken by journalists as a sign that big banks are increasingly looking to partnerships to remain relevant.

Meanwhile, rival JPMorgan launched a challenger neobank of its own in the UK under its consumer brand, Chase, in a move that was perceived as threatening to shake up the banking sector. JPMorgan became the second major US lender to enter the UK retail banking market, since Goldman started offering Marcus-branded digital savings accounts 2018.

Much of the conversation around start-ups was also focused on their expansions during the pandemic. For example, Revolut was mentioned for its plans to hire 300 staff in human resources, finance, growth, marketing and other functions for its subsidiary in India and make a multi-million pound investment there as part of its global expansion.

Brazilian digital bank Nubank started preparing for a US stock market listing, which is expected to be one of the biggest stock market debuts of a South American company in recent years. Since its launch in 2013, Nubank gained more than 35 million clients, launched new financial products such as checking accounts and loans, and expanded throughout Latin America.

Sweden’s Klarna, one of the most successful European fintechs, received media attention for achieving a $31 billion valuation in March, tripling its value from six months prior. It also made its Super Bowl debut to stand out from rivals like Affirm and PayPal.

Еarlier in 2021, Stripe became the most valuable startup in the United States with a valuation of $95 billion, while UK-based Curve announced that it’s raised $95 million to fuel an expansion into the US. In Asia, telecom company SingTel obtained one of Singapore’s first digital banking licenses – a move that was viewed as a potential precursor to similar moves into Malaysia and the Philippines, as they prise open their banking sectors.

Meanwhile, Chinese conglomerates Alibaba and Tencent featured in the discussion as they have become giants in payments and investing thanks to their mobile payments apps. In China, AliPay and WeChat Pay have made it possible for customers to bypass credit and debit cards. Some journalists explained their growth with the country’s economic development, urbanisation and the emergence of a vast middle class.

Neoinfluencers

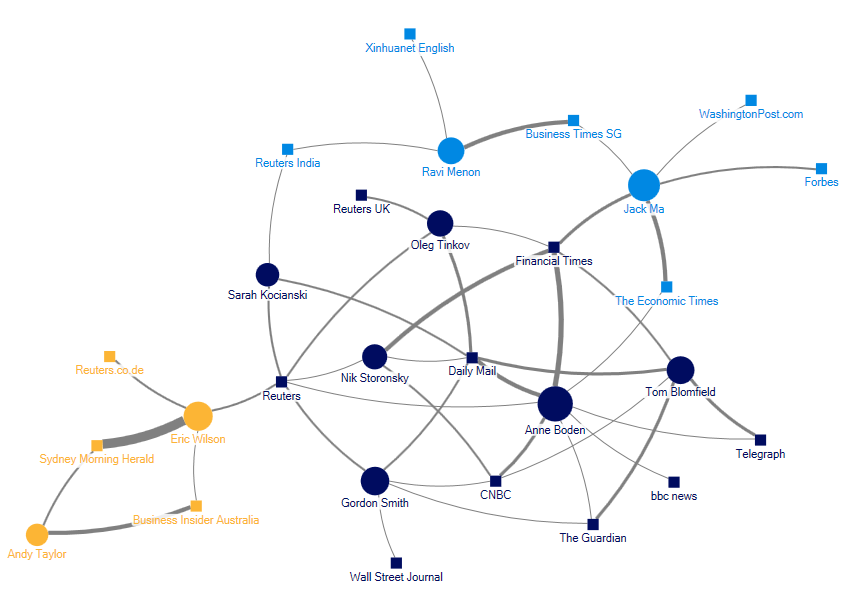

We employed Influencer Network Analysis, our patented methodology that uses natural language processing (NLP), text mining, dynamic visualisation and human enrichment, to analyse the recent media discussion around neobanking and the influencers under the spotlight.

The media discussion around the relevant healthcare companies is presented as a two-mode network map (see below), displaying the influencers (circles) and the publications (squares) that referenced them in the neobanking coverage. The size of the circles indicates the influencer’s prominence in the media discussion, and the width of the connections between the individuals and the publications is indicative of the coverage volume.

The bulk of the influencers came from neobanks, with Anne Boden, CEO of Starling, being the most influential individual in the debate. Publications like the Financial Times, CNBC and the BBC mentioned her not only in reports on Goldman’s investment in Starling but also in analyses on female leadership in the financial services industry.

Boden told the BBC that “women have to achieve more, work harder and be much more perfect to get the job compared to a man,” and that the experience of being treated differently because she is female only inspires her to work harder.

The rise of neobanks and fintech start-ups as a whole has been perceived as ushering in more opportunities for women to become leaders. Banking has been an industry with a palpable presence in the gender diversity media debate – for example, Goldman Sachs received a flurry of media attention after announcing at Davos that it will carry out IPOs only for companies that have at least one woman or non-white board member.

According to some commentators, this pledge would make Goldman one of the first investment banks to mandate diversity among clients. The bank has had a long-standing reputation as the ultimate ‘old boys’ club’, reinforced by articles such as New York Magazine’s ‘The Head of Goldman Sachs Will Always Be Bald’.

As Wall Street has been trying to address its gender problem for more than a decade, there were other positive developments: for example, HSBC has come in equal seventh among 100 FTSE companies for female representation on its board (46%). Meanwhile, Jane Fraser’s rise to CEO of Citigroup – the first woman to lead a big Wall Street bank – hit many headlines.

For more on this topic, read our analysis “Gender Equality: Has Covid Intensified the Debate?”

The second most influential individual, Eric Wilson, co-founder of Xinja, was mentioned by outlets like Daily Mail and The Guardian because of his bank’s failure – Xinja became the first Australian bank to return all customer deposits and to surrender its banking licence after it failed to develop a sustainable business model. Wilson told Business Insider Australia earlier in the year that the bank had been “punched in the face” but that it was picking itself back up off the mat.

In the meantime, Monzo founder Tom Blomfield was quoted for his decision to quit the digital bank because he struggled with his mental health during the pandemic. He also said that he has not enjoyed working for Monzo in the two years since it transformed from a start-up into a major brand with almost 5 million customers.

Nik Storonsky, CEO of Revolut, gained his prominence for his assertion that if he was starting a payments business today, he would think digital banking wouldn’t be attractive because the capital requirements are so much tighter – referring to the Financial Conduct Authority’s plan to enforce new rules that experts say will drive up costs.

To get a taste of the social media conversation, we analysed 18,399 tweets posted between May 2020 – May 2021 As with everything relating to technology, cryptocurrencies, blockchain, AI or innovation as a whole, the social media discussion around neobanking is very dynamic, with many influencers regularly sharing thought leadership.

Spiros Margaris, venture capitalist and futurist, and the founder and owner of Margaris Ventures, was with the highest influence score. He is a well-established thought leader and a frequent speaker at international fintech and insurtech conferences.

Recently, he suggested that although some claim the fintech industry has already seen the most exciting achievements it has to offer, there’s a lot more still to see, because to date, fintechs — from neobanks to trading apps — have picked only the low-hanging fruit. He also tweets a lot about Bitcoin, saying that it is much more than a speculative asset.

Margaris was followed by professional financial association Interfima and its director, privacy advocate Marc R Gagné, who shares cybersecurity-related news – a recent example was that Toshiba and Ireland’s health ministry were hit by separate ransomware attacks.

The most influential individual from a tech firm was Urs Bolt, product manager of digital banking at Swiss software firm ti&m, who recently tweeted that while tech innovations are driving digital banking, most banks’ core systems can’t keep pace nor leverage innovations.

From the investment community, particularly influential were Theodora Lau and Bradley Leimer of Unconventional Ventures, a US financial wellness consultancy. The most prominent journalists were Jim Marous, host of the Banking Transformed podcast, and Christian König, Founder, Fintech News Network.

The only neobank CEO was Brett King, the chief exec of Moven, one of the first challenger banks, which closed its US consumer financial services operations in 2020 due to lack of funding but continues to operate as a mobile banking and financial technology application developer.

King is regarded as an influencer in financial services globally, writing for outlets like the BBC and the Huffington Post and producing on-air interviews with women leaders in the financial tech sector. He recently tweeted that COVID-19 has thrust us into a situation where we have become necessarily reliant on digital infrastructure and this need to complete transactions digitally instead of in-person has emphasised the disparity in digital inclusion.

Revolut, Starling and Monzo were the neobanks that appeared among the most influential accounts. They all relied on value-based messaging – Revolut, for example, used Twitter to introduce a system supporting charities that offer aid to India (which is heavily hit by the pandemic), while waiving fees on external bank transfers to India for 30 days. It also shared that its proud to support Royal British Legion and the Poppy Appeal.

During Mental Health Awareness Week, Starling tweeted that money and mental health are connected in more ways than we might think, and pledged support of Public Health England’s #EveryMindMatters campaign. Similarly, Monzo tweeted that people with mental health problems are three times more likely to be in financial difficulty than those without, ans shared its committed to improving our understanding and support of customers that need it.

What kinds of comms challenges do companies face with neobanking?

Based on our media analysis, we identified the main comms challenges when it comes to digital banking:

- For traditional banks, the biggest comms challenge would be to reposition themselves as in tune with the latest technological trends. A more pronounced focus on innovation might be helpful with restoring banking’s damaged reputation, as finance brands continue to experience reputational setbacks, with customer satisfaction being at an all-time low. According to Edelman’s 2021 Trust Barometer, after seeing a significant rise in trust at the outset of the pandemic, financial services saw a sharp trust decline at the turn of the year. But in our research sample, Wall Street giants Goldman Sachs and JPMorgan were covered in a positive light as trying to stay relevant.

- For big tech brands, the main challenge would be to make consumers trust them with their financial data – some of the most sensitive information there is. Apart from Google, other players are also looking to step in. Facebook launched WhatsApp digital payment service in Brazil as the messaging app capitalises on its popularity in emerging markets. However, if Facebook wants to double down in this space, it might need to change its comms practices. For example, when WhatsApp was recently hacked, exposing a “serious security vulnerability”, Facebook didn’t address the issue or notified users more than 12 hours after the Financial Times broke the story – a problem which many media outlets compared to Facebook’s bad response to the Cambridge Analytica scandal, saying that the company is still slow to talk to its users about privacy.

- For start-ups, which don’t have the PR and marketing budgets of banking and tech giants, the biggest challenge to be to win over consumers who prefer to have face-to-face contact or a traditional bank with history and not one that was launched two years ago. As start-ups rely heavily on social media, a good practice would be to engage with interactive and collaborative communication with stakeholders, which may include soliciting feedback, ideation, crowdsourcing of solutions, and knowledge co-creation. Another key step would be to turn their CEOs into full-time brand ambassadors – read our analysis on how media analytics could help with that.

Trackbacks/Pingbacks