The legal twists and turns of the market have dominated the recent media discussion around biosimilars, while the general awareness of the drugs among patients, physicians and pharmacists remains relatively low. Using our Influencer Network Analysis (INA) methodology, we identified the most influential companies and spokespeople in the conversation.

Biosimilar drugs – copycat versions of biological drugs whose patents have expired – are expected to shake up the pharmaceutical industry in the US and Europe as a growing number of biologics near the expiration dates of their patent protections.

Biosimilars are seen by most media outlets as a financial salvation as they aim to reduce the price burdens of biologics, which are among the most expensive drugs on the market and represent a major expense for patients and healthcare providers. In fact, biologics account for some of the highest-rising drug prices, followed by brand-name medicines and generics (copies of brand-names without patent protection).

As a result, the media’s sentiment on the biosimilars’ future is predominantly positive, with many commentators citing promising forecasts, such as McKinsey’s estimate that the biosimilars global market could triple to $15bn by 2020, or RAND Corporation’s prediction that they could reduce US healthcare spending by $54bn in the next 10 years.

Financial outlets also present a generally positive investment outlook, with up to US$60 billion in global pharma spending expected to be redirected from blockbuster ‘innovator’ drugs to emerging biosimilar competitors. The growing investor interest has made some specialised publications to speak of an upcoming market disruption and a rising threat for branded pharma companies.

But some critics have recently noted that US sales have been so scarce that the sector’s future is in doubt: since 2015, when biosimilars were given the regulatory green light in the country, the Food and Drug Administration has approved 24 biosimilars, just 11 of which are actually for sale with rather poor results.

Challenges ahead

The media conversation around biosimilars has become more nuanced in the last year or so, with an increasing number of outlets warning that there are some intellectual property and regulatory challenges which can slow down biosimilars’ potential to ensure more affordable and accessible healthcare for consumers and revenue streams for pharma companies.

In fact, the legal complexities of the market are the main topic in the media discussion around biosimilars during the last nine months:

Articles within the ‘legal issues/lawsuits‘ topic concentrate mainly on the US, where the market entry of biosimilars has been delayed by many lawsuits filed by patent holders of the reference biological drugs. Some companies are reportedly waiting for the major biosimilar producers to resolve their litigation conundrums before investing, which explains the growing interest in legal news in the sector.

The media has started to follow the litigation processes in this area since 2010 enactment of the Biological Price Competition and Innovation Act (BPCIA), part of Barack Obama’s Affordable Care Act, which enabled an abbreviated FDA-approval pathway for the development of biosimilars. The media discussion significantly intensified after biosimilar versions of the world’s best-selling drug, Humira, appeared in Europe when its European patent expired in October 2018.

In the US, seven pharma companies requested regulatory approvals for their own biosimilars of Humira. AbbVie, which launched the drug 17 years ago, sued each of these rivals, citing an array of add-on US patents – something which it couldn’t do in Europe, where add-on patents aren’t a thing. All the companies have now settled, agreeing to pay AbbVie royalties so they can start offering their Humira biosimilars in 2023.

The media’s focus on the legal issues around the world’s best-selling drug made AbbVie the most often mentioned company in the conversation around biosimilars:

Amgen, Samsung Bioepis, Mylan, Pfizer, Novartis, Fresenius Kabi and Boehringer Ingelheim were also frequently mentioned in relation to their patent disputes with AbbVie, as well as to the approvals and eventual launches of their biosimilars, which were discussed within the ‘approvals/launches‘ topic.

The last company to settle, Boehringer Ingelheim, accused AbbVie of improperly creating “a ‘patent thicket,’ comprising more than a hundred overlapping and non-inventive patents, for the sole purpose of extending its monopoly far beyond the expiration of its core patent for Humira in 2016.”

In most publications, AbbVie was seen as trying to sustain its market monopoly of Humira, which accounts for 60% of its sales. Some outlets such as NBC and Bloomberg suggested that this was part of Big Pharma’s tendency to play the patent game to ward off competitors and to prolong the commercial dominance of brand-name medicines.

More legally-savvy commentators suggested that AbbVie‘s litigation strategy has highlighted the need for patent reform in the US. In general, the conversation around Humira has contributed to the common public perception that pharma companies manipulate the system to keep drugs expensive. This notion has played one of the central roles in the pharma industry’s ongoing reputation problems.

In the US, the country most articles refer to, the pharma industry experienced a reputational decline since last year, which has had a negative impact on consumer confidence. The Reputational Institute has calculated that the decline amounts to -3.7 points and pointed out that consumers are less likely to give pharma companies the benefit of the doubt or to trust them to do the right thing.

Intensifying competition

AbbVie was also discussed within the ‘financial results‘ topic for reporting lower-than-expected quarterly earnings and a forecasted 26% to 27% decline in 2019 Humira sales outside the United States due to competition in Europe coming from rivals such as Mylan and Biogen. Humira’s sales are also forecast to fall from $18bn last year to $14bn in 2024, and AbbVie‘s shares have lost more than a third of their value since the beginning of 2018.

Under pressure to diversify its portfolio, the company became subject of articles such as Where Will AbbVie Be in 10 Years? One of the answers came when it acquired Allergan, the manufacturer of the famous wrinkle treatment Botox, for around $63 billion.

Discussing the acquisition within the ‘business strategy‘ topic, many outlets pointed out that AbbVie is taking this step because it couldn’t game the patent system forever and its lawyers ran out of loopholes, which created the need for a new lucrative brand-name drug. Furthermore, Botox isn’t protected by a patent but by a trademark, which doesn’t expire.

AbbVie‘s communication strategy relating to Humira has been rather interesting: high-profile publications such as the New York Times and the Financial Times noted that the company wouldn’t discuss its best-selling product and declined requests for interviews.

The drug maker addressed the issue by publishing a statement which says that it “welcomes the introduction of biosimilars that have demonstrated they are as safe and efficacious as their reference products”, but it also argued that “patients who are stable on their existing biologic therapy should not be switched to another product for non-medical reasons”.

Within the ‘regulation/policy’ topic, media outlets noted that regulatory and market access issues have made it difficult for many investors to make decisions about entering the market with confidence. Not many commentators consider the sector mature enough, but they are rather optimistic for its growth once regulatory pathways become more established.

As with many healthcare subjects, journalists juxtaposed the US with Europe, where patents don’t last as long and state-funded health systems have put the continent ahead of the rest of the world in the adoption of biosimilars. The UK’s National Health Service (NHS), for instance, has shifted 80% of eligible patients on to a biosimilar version of Rituximab, a blood cancer drug manufactured by Roche.

One of the top-trending news stories within the ‘regulation/policy’ topic was the Food and Drug Administration issuing the Biosimilar Action Plan which strives to improve biosimilar development and approval, and scientific and regulatory clarity. Novartis, Roche and Pfizer were mentioned most often in this context for reacting positively to the news.

All about the money

Roche, the world’s biggest producer of cancer drugs, dominates 2019’s big patent expiries. The company featured in the ‘business strategies‘ topic for stepping up cost cuts in an efficiency drive caused by competition from biosimilars of its three best-selling cancer medicines Rituxan, Herceptin and Avastin.

Biosimilars of breast cancer drug Herceptin, for instance, have led to the company broadening the use of its Kadcyla breast cancer treatment. Most recently, the Food and Drug Administration approved Pfizer‘s biosimilar to Avastin. In spite of the competition, Roche’s third-quarter revenue beat analysts’ expectations as new medicines such as Ocrevus for multiple sclerosis performed well and as China bought more of older medicines whose sales are dropping elsewhere due to patent expiries.

Roche‘s Herceptin and Avastin have been prominent coverage drivers in the media debate around drug pricing since the mid-2000. Drug price levels have been one of the hottest topics discussed in the US media in the last 30 years, with the conversation being intensified by the launch of a number of breakthrough high-cost speciality medicines such as Roche‘s, whose prices (often above $100,000 per treatment course) stirred up growing discontent.

The overall sentiment within the ‘drug pricing‘ topic is that biosimilars could be an effective way of reducing healthcare costs. Promoting the introduction of biosimilars was also one of the main subjects at the February Congress hearing in which Merck, Pfizer, AbbVie, AstraZeneca, Bristol-Myers Squibb, Sanofi and Johnson & Johnson testified about high US drug prices.

Many articles fell under both ‘drug pricing’ and ‘regulation and policy’ topics, since healthcare costs have always been on the agenda of presidents, senators and of the Congress, and are currently a major focus of the Trump administration. Many critics from across stakeholder groups have pointed out that the value of medicines is not established in a reliable manner since US policy makers have traditionally been relying on the market to determine the prices and have not implemented relevant regulations.

Some commentators referred to examples from Europe and Canada where drug prices are determined via value-based (health technology assessments, pharmacoeconomic analyses), reference-based (international and therapeutic price referencing) and risk-based (managed entry agreements) approaches.

Corporate spokespeople from pharma companies have usually tried to justify high prices with innovation. Indeed, the media coverage of medical breakthroughs (such as orphan medicines) has been increasing since the 2000s. The Food and Drug Administration has also tried to facilitate the access to novel medicines by introducing regulations such as priority review, accelerated approval, fast track review and breakthrough designations.

However, the innovation argument has often been challenged. Critics have suggested that costs have gone up not because of innovation efforts but because companies are raising the price of drugs that are already on the market, with the lack of competition and the US regulatory landscape allowing for price increases much higher than in other countries.

Non-traditional players disrupting the industry, such as Amazon, are increasingly being mentioned in the media discussion around pharma and drug pricing.

Unlike many media conversations around healthcare, in which politicians and government representatives have a large share of voice, the media debate around biosimilars has been dominated by corporate spokespeople:

AbbVie’s Richard Gonzalez was quoted in relation to accusations of manipulating the patent system in the Humira litigation cases, which he denied, explaining that the company improved and refined the manufacturing and the formulation of the drug over time, and “there’s nothing inappropriate about protecting that investment in innovation”.

He also said that Biogen and Amgen had been the most aggressive biosimilar rivals in Europe, and was bullish about AbbVie’s portfolio of cancer treatments, sharing his confidence of delivering double-digit earnings growth in 2019 in spite of the competition.

While Gonzalez was quoted in a rather defensive tone, Novartis’ Vas Narasimhan has been trying to communicate his company’s leading position in the disruption. He said that it remains committed to Novartis’ unit Sandoz, whose strategy of transformation and shifting the focus to complex generics and biosimilars “is on the right track”: “Challenging environment, but I think we’re taking the steps necessary to put the division in a place where it can succeed.”

Meanwhile, Roche’s Schwan is expecting biosimilar competition in the US market to intensify from the second half of this year. Pfizer’s Bourla took to social media to share his thoughts on the subject, publishing a LinkedIn post titled “Unlocking the Promise of Lower-Cost Biosimilars”. The importance of biosimilars was also highlighted by Jeffrey Francer of the Association for Accessible Medicines, who said that they are the affordable versions of some of the most expensive drugs in the world.

Mapping the influence

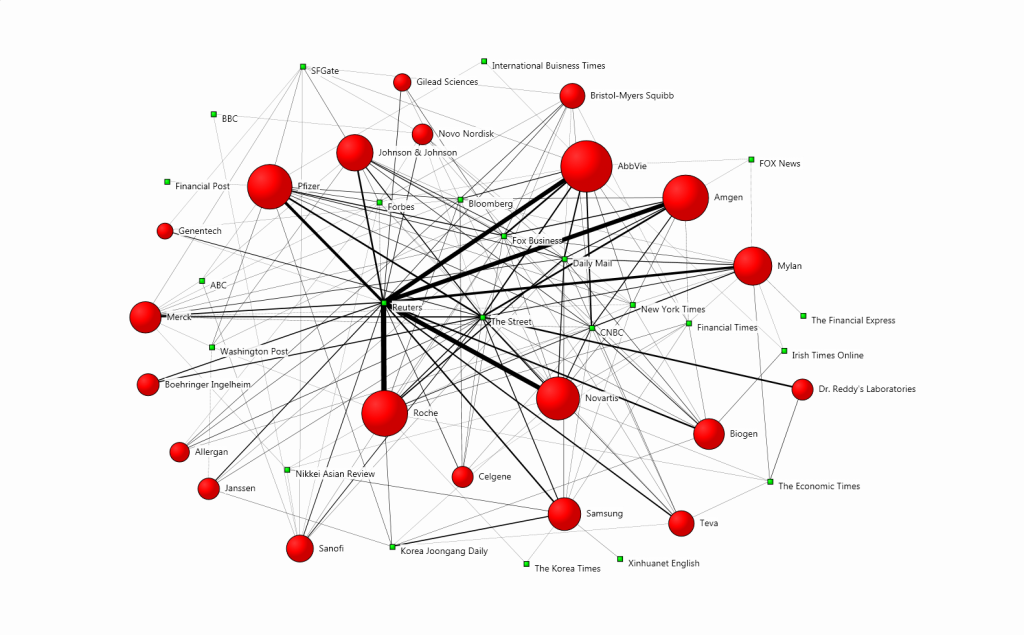

To identify the most influential brands in the media conversation around biosimilars, we used our Influencer Network Analysis (INA) methodology, which employs natural language processing, entity extraction, free-text data mining and dynamic network mapping technology, complemented by human-led analysis.

The following map visualises the relationship between the companies driving the conversation and the media outlets that referenced them most often – in this case, at least two times. The size of the red circles indicates the brands’ prominence in the media discussion, and the width of the connections between the brands and the publications is indicative of the coverage volume.

The most prominent companies in the debate featured primarily in business-oriented publications such as Reuters, The Street, Fox Business and CNBC. For instance, AbbVie, Amgen, Novartis, Roche and Pfizer were mentioned most often in Reuters, which published the highest number of articles on biosimilars and focused on the ‘legal issues/lawsuits‘, ‘financial results‘ and ‘business strategies‘ topics.

The Street also focused on companies such as Dr. Reddy’s Laboratories, which has been described as one of the strongest Indian players in the sphere. The company increased its biosimilars investment and was reported to focus on scaling up in its major markets, which include Russia, China, Brazil, South Africa and Ukraine.

Sanofi said it has a biosimilar version of Eli Lilly‘s Humalog that it sells under the name Admelog. The company was also mentioned for its ambitions for connected technology in diabetes – the company has pushed digital, integrated diabetes efforts through its joint venture Onduo, and with Verily and Sensile Medical.

One of the most prominent market disruptors, Samsung, was the focus of publications such as the New York Times and Financial Times because of its unit Samsung Bioepis, a joint venture between Samsung BioLogics and Biogen, which launched biosimilars of AbbVie‘s Humira and Roche‘s Herceptin.

Analysing the media conversation, one can easily get the feeling that the main messages around biosimilars appear to be directed to investors rather than to the general public. This seems reasonable because the investment case is still not completely clear mainly due to legal hurdles and regulatory unknowns.

Although many major players have invested in the sector and there have been a number of joint ventures and licensing transactions, many investors could be deterred by the latest string of news headlines focusing on legal issues. Companies might see a stronger need to step up their investor relations efforts as the market matures and returns become easier to outline.

The heavy focus on market-centred media content has had its drawbacks: the general awareness and knowledge among patients, physicians and pharmacists remains relatively low. This is also due to the lack of systematic efforts at educating physicians and patients who are concerned about biosimilar safety and efficacy.

A recent systematic review found that US and European healthcare providers still have inadequate knowledge, perceptions, and prescribing behaviours related to biosimilars, and are being cautious partly due to a lack of awareness. In the meantime, healthcare communicators have been highlighting the increasing need for educating the public, physicians, and patients about biosimilars.

Physicians and pharmacists should be confident enough in biosimilars to recommend them in lieu of familiar brand names, while patients should be well aware of the efficacy and safety of the drugs. Payers and providers must convey clear messages about the safety and reliability of these alternatives, but key opinion leaders in the pharma industry have an important part in raising awareness across stakeholder groups.

In the case of biosimilars manufactured by big pharma companies, trust can be built by using the benefits of an already established corporate brand. In the case of emerging pharma or biotech firm, a strong product message could rely on a value proposition positioning the biosimilar as a new product offering benefits that go beyond the reference drug.

Even though biosimilars have to align with the reference biologics in terms of quality and performance, underlying any additional benefits might be an effective selling point. In this regard, there have been suggestions that biosimilars should be promoted as brands in their own right, with distinctive value propositions that distinguish them from their predecessors.

Read our analysis “PR Measurement in Pharma: The Key to Effective Communication Strategies”.