In the dawn of AMEC’s Measurement Month, a global programme of activities shining the spotlight on the importance of PR measurement, we thought we could highlight the immense value of PR measurement by surveying its applications in an industry suffering from a growing trust problem – pharma.

The reputation of pharmaceutical companies depends on the quality of their formal reputation management. There is a positive correlation between enjoying good reputation and implementing an on-going PR measurement programme: a study on corporate reputation management in the US pharmaceutical industry concluded that pharma companies with better corporate reputations demonstrated a greater commitment to measurement. The majority (88.89%) of pharma companies on Fortune magazine‘s “World‘s Most Admired Companies” list actively measure their corporate reputations.

This conclusion serves as a corroboration of the PR truth that more and more pharma companies come to realise – that having a precise, data-driven understanding of the state of your corporate reputation is an essential prerequisite for being able to manage it successfully.

As the authors of the research point out: “In order to take control of and maintain corporate reputation, measurement is necessary. A firm must identify where it stands, evaluate whether its strategy is working and analyse the end results of any strategic reputation management activity. Actively, continuously and comprehensively measuring firm reputation is a necessary component of reputational success.”

Here we’ll outline the results of several studies we conducted on the importance of measurement in the communication strategies of pharma companies. We managed to identify the hottest trends in the media coverage of the industry: the big tech disruption, the emerging start-up scene, gene therapies, Alzheimer’s and mental health. These are the five central topics in the discussion of pharma today, so every communication professional should be aware of the way the conversation is carried on.

Big pharma vs big tech

The global healthcare sector is facing huge disruption by tech giants: we are encountering the names of Amazon, Apple, Facebook, Google, Microsoft and even Uber in a healthcare context more and more often. Having already entered industries such as finance and media, tech heavyweights are eyeing the lucrative health sector, where global spending is expected to reach $8.7 trillion by 2020.

The emerging competition between big tech and traditional healthcare providers is also starting to play out on the media front. We tried to dissect the new trend while it is still in its infancy.

Most of the articles strive to explain the reasons why the healthcare market is ripe for disruption, and often cite rising costs, administrative inefficiencies, customer dissatisfaction and the growing need for medical care against a backdrop of staff shortages. As a result, the healthcare industry in this coverage suffers from a negative reputation, which is naturally dangerous for the established companies in this field. In the US, the country most articles refer to, the pharma industry experienced a reputational decline since last year, which has had a negative impact on consumer confidence. The Reputational Institute has calculated that the decline is -3.7pts and pointed out that consumers are less likely to give pharma companies the benefit of the doubt or to trust them to do the right thing.

The low number of mentions of pharma companies in this coverage exemplifies the pharma industry’s reputation for lagging behind with innovation. This is maybe due to the fact that the sector is generally perceived as conservative, burdened with many regulations and reluctant to take risks. As we saw in our brief review of their innovation activity, this is not the case – many technological advancements are taking place within the industry, it is just that they are not as well covered by the media as the tech sector’s efforts in this direction.

Here is where pharma PR professionals should step up their strategies. In the face of new competition, they should strive to change the image of the industry and present their companies as open to innovation and ready to explore new territories, just like the disruptors. They should underline the strategic growth opportunities in their sphere, be it by promoting more effectively their mergers and acquisitions or emphasising the value of their corporate ventures and partnerships with digital platforms. The public needs to understand that pharma is not struggling to keep pace with the latest changes in digital technology.

Analytics solutions can help with this task as well, for instance by identifying key pharma and tech influencers and designing influence-based marketing strategies reaching beyond healthcare professionals. Such an approach could effectively tie a brand to the notion of innovation. A more targeted PR plan would enhance the company’s image of being customer-centric and will take advantage of the current trend in the sector to shift from product-centricity to patient-centricity.

In this way, utilising analytics tools should become a priority not only for medical researchers, but also for communications professionals who want their brands to stay ahead of newly emerged competition.

Pharma start-ups

Healthcare is attracting more “crossover investors” such as hedge funds which support start-ups all the way through their initial public offerings (IPOs). According to the Nasdaq Stock Market’s reports, the third week of June alone saw eight biotech companies go public, securing $645 million. As a result of these investments, start-ups have become the main drivers of pharma innovation, bringing in 63% of all new prescription drug approvals during the last five years.

Indeed, funding was the main topic in the media coverage of pharma start-ups in the last three months, as our analysis has established. Much of the coverage was dedicated to pharma giants investing in new companies, and some analysts noted that this growing trend constitutes a “paradigm shift in big pharma”. The conclusion drawn in many reports was that industry giants are taking a more entrepreneurial approach by launching venture capital funds and supporting start-ups to bolster their own drug offering. Many articles explain this process by pointing out that pharma heavyweights have been struggling with the development of truly innovative products, and want to reduce the risks in their in-house research and development processes.

Our analysis also found which pharma giants were mentioned most often in the context of their engagement with start-ups. Unlike them, the names of successful start-ups did not get that many mentions. Naturally, the more popular ones are those entering lucrative deals or attractive significant investment, but start-ups need not rely on such successes to build up a media presence in the early stages of their formation. The emergence of fresh names on the scene might also be beneficial for the shaky reputation of the pharma industry in which they operate.

The situation is not the same with start-ups in other industries – in finance, for instance, new firms get more coverage, as our survey of the financial sector has demonstrated. This is in part due to the fact that fintech companies are much more eager to promote the innovativeness of their solutions – something which pharma start-ups would be well-advised to do, especially since the pharma sector has a reputation for lagging behind with innovation and for being reluctant to take risks.

Pharma heavyweights should continue to spread the word for its investments in new innovative firms, but they should also promote more actively those firms themselves. As we established in our previous healthcare feature, big pharma is facing mighty competitors coming from the big tech ranks. Boosting the brand awareness of their new allies will be of great help to pharma giants – with start-ups having become the main drivers of innovation in this sphere, promoting them would mean promoting the ingenuity of the whole industry.

The gene therapy trend

The media quickly fell into the habit of hailing gene therapies as the future of healthcare and the hottest innovation of our time, and journalists in specialised and daily outlets alike often speak of reinventing or revolutionising the industry. Reading through the coverage of gene therapies in the last three months, we found that the articles refer to six topics: research, investment, M&A, partnerships, people moves and expansions.

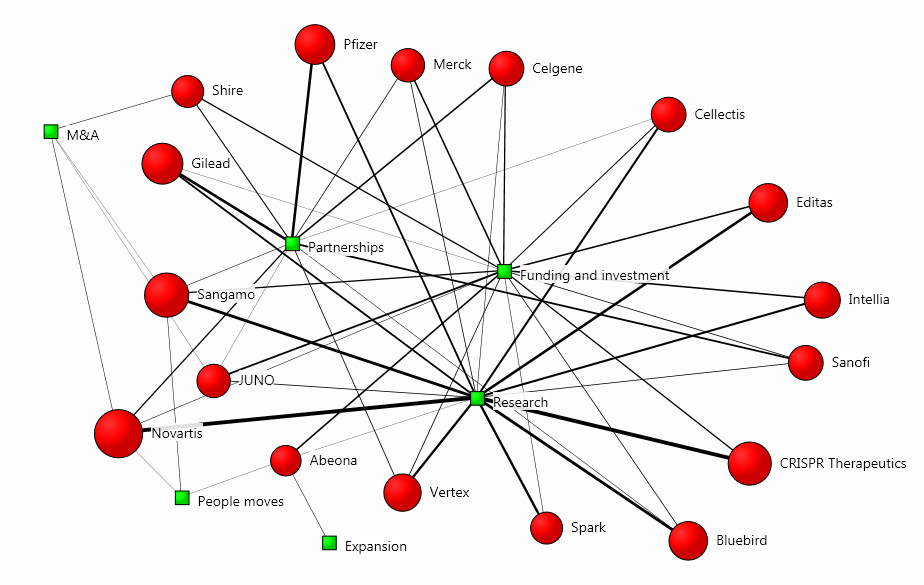

The bulk of the articles evaluated the research of certain firms in order to draw conclusions about their investment potential. In the cluster map below, we can see how each organisation relates to the main topics in the coverage:

The map was drawn using our Influencer Network Analysis (INA) methodology, which incorporates natural language processing, entity extraction, free-text data mining and dynamic network mapping technology. The size of each firm’s red circle signifies the prominence of its presence in the coverage, and the strength of its connection to a theme visualises the degree of association with the main topics.

The methodology is particularly useful when analysing such new trends, because it depicts diffusion patterns and correlational links between key influencers and emerging issues, thus serving as a stepping-stone for more ambitious communication campaigns.

Naturally, major drugmakers have developed a keen interest in gene and cell therapies. As per usual when it comes to innovation, pharma heavyweights acquire or collaborate with start-ups or small specialised companies. The media is increasingly eager to analyse these ventures, as we already identified in our recent research on pharma start-ups. In the case of gene and cell treatments, journalists almost unanimously hold that small-cap biotechs are the real pioneers, and that gene-editing tech will soon be everywhere thanks to their work.

Many of them also feature in pieces exploring research and investment. Unlike the coverage of pharma start-ups, it can be noticed that the number of articles mentioning big players and those mentioning small specialists doesn’t differ significantly. This goes to show that the media is well aware that the latter are the main force behind innovation in advanced therapies.

PRs have capitalised on the promises by promoting the therapy’s potential as a revolutionary advance in medical science. A sign of this is the more frequent use of the word “cure” in the coverage – a word which the medical profession and its PR teams are traditionally hesitant to utter. Due to the predominantly futuristic sentiment in the reports, it is important for PRs to make sure that gene therapy won’t become a subject of conspiracy theories.

As the field promises to grow exponentially and attracts many investors, communication professionals should carefully deal with their expectations. Investors should be aware that this is still a volatile field where news of unsuccessful trials could lead to sharp drops in valuation, as it already happened with Juno Therapeutics, for instance.

Studying the coverage using analytics tools is an effective way to get a grasp of the trend while it is still in its infancy. This would serve as a good starting point for drafting a strategy in an area where influencers, thought leaders and trend-setters are yet to establish themselves.

Alzheimer’s

The quest for a better way of detecting the first signs of Alzheimer’s is now a fierce competition. The rate at which people are diagnosed with Alzheimer’s is luring more and more pharma and biotech firms, although the high failure rate and the high costs of drug development often dash the hopes of investors.

In an environment where scepticism is the default attitude, introducing a new product is always a considerable challenge. Pharma as a whole has an ongoing trust problem – for instance, just 38% of Americans report that they trust pharma companies, down 13% from 2017, according to Edelman’s 2018 Trust Barometer. In the case of Alzheimer’s, the long-term lack of progress puts even more hurdles on the rocky road to consumer confidence.

In the search for solutions, we should turn to another finding of Edelman’s Trust Barometer: that every healthcare company must “activate the chorus” to tell its story because the voices of authority within the industry have regained credibility. The percentage of consumers who trust spokespeople has risen: the most credible voices of authority are technical experts (trusted by 63% of consumers) and academic experts (trusted by 61%). On the other end of the spectrum, the least credible sources are journalists, and government officials and regulators.

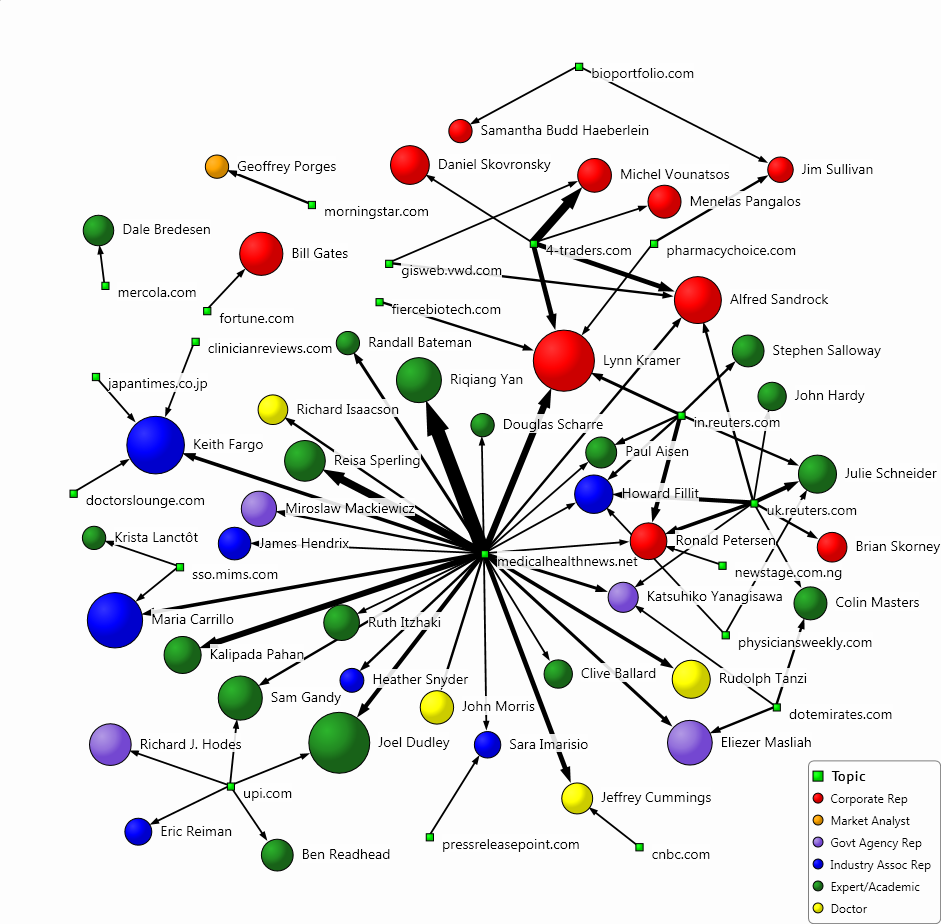

This means that a well-designed influencer campaign involving technical and academic experts would go a long way. Using our Influencer Network Analysis (INA) methodology, we analysed the most recent Alzheimer’s coverage to determine whose voices are the loudest. In this way, we managed to find out who are the key opinion leaders driving the discussion. In order to illustrate how different influencers are interconnected in the coverage, we drew a cluster map with the help of our Influencer Network Analysis (INA) methodology:

As it can be seen on the map, the most vocal commentators were experts and academics, and they have strong connections to each other as they are mentioned in research reports together. They usually have links to corporate representatives when commenting on some findings – for instance, neurologist Stephen Salloway of Brown University gave his opinion on the Eisai/Biogen drug, and this constituted his relation to Kramer.

The dominance of experts and academics is due to the fact that most articles are about scientific advancements, drug trials and new research programmes. The academics are also active as third-party commentators on new developments in the market. By getting so much media attention, academics and experts have positioned themselves as the primary power of influence in the Alzheimer’s debate.

Deep diving into the coverage, we found out that the articles featuring influencers’ opinions are the ones top trending on social media. The fact that such stories became top trending aligns with Edelman’s finding that the voices of authority within pharma has regained credibility: people are more likely to share what they find credible, so it’s no surprise that expert commentary makes stories diffuse farther and deeper. Leveraging social media in such a manner is incumbent on pharma companies – for more on that topic, take a look at our Social Media in Pharma blog post.

The inevitable conclusion from our case study is that if pharma players want to dip their toes into challenging markets like Alzheimer’s, they would need to draft an effective influencer-based marketing campaign. The public has already fallen into the habit of taking the news about new projects with a pinch of salt. Such levels of scepticism have to be overcome with a marketing strategy bolstering the confidence of consumers and enhancing the corporate image of firms.

Since commentary by experts and academics are what lends credibility to brands and ensures the deep diffusion of messages, an influencer-based PR strategy involving the most trusted commentators would secure a powerful media presence. And keeping an eagle eye on the opinion-makers and trend-setters via sophisticated analytics tools is a productive modus operandi when designing such campaigns.

Mental health

Research And Markets’ study Corporate Reputation of Pharma Companies, 2017-2018 – The Patient Perspective of 101 Mental Health Patient Groups found that nearly half of the mental health patient groups didn’t liaise with any pharma company, and 11% worked with only one or two. The study ranked Janssen, a subsidiary of Johnson & Johnson Pharmaceutical Research and Development, first out of 14 for corporate reputation. Second and third were Lundbeck and Eli Lilly, while Merck, Boehringer and Sanofi came last.

Analysing the mental health coverage, we discovered that the level of public awareness is markedly rising and the conversation about various mental issues is becoming livelier. This is due to the higher number of celebrities and influencers who have opened up about their own struggles, including Kendall Jenner, Adele, Beyoncé, Emma Stone, the late Carrie Fisher, Selena Gomez and so on. Some have even started campaigns – for instance, Prince William, Kate Middleton and Prince Harry launched Heads Together to raise the profile of mental health.

In a conversation driven mainly by public figures, pharma doesn’t come up often. There are numerous articles on topics such as depression, anxiety and panic disorders, but they rarely mention the industry’s contributions, and there are no established pharma influencers speaking on these issues. Some general facts and figures are well-documented, for instance, that nearly 18% of American adults and 20% of children experience a mental illness in any given year, or that depression affects 300 million around the world. But there isn’t much awareness that biopharmaceutical research companies are developing more than 140 medicines to fight these problems.

The coverage of these topics which didn’t mention the developments in the pharma world was much more extensive. PR professionals in the industry should take note and put in an effort to position their companies as thought leaders on mental health issues. Launching campaigns and navigating the social media environment is just the beginning. The increasing liveliness of the debate creates excellent conditions for new commentators to bring in some fresh insights and establish themselves as influencers.

Pharma spokespeople could learn a lot by the manner in which conversations about mental health are driven, notably by celebrities. Demonstrating a genuine interest and understanding, and stripping off the industry’s usual corporate voice, could go a long way in reaching the many people involved in the discussion. With this in mind, the communication strategies of pharmaceutical companies would certainly benefit from the application of robust PR measurement programmes.