While the presidential election, the pandemic and racial reckoning were stories that drove intense interest and engagement to news outlets in 2020, some metrics suggest that 2021 represented the inevitable hangover: engagement with news content plummeted last year compared to 2020 due to the decline in interest in news about COVID-19 and politics.

It seems like the Trump era and the onset of the COVID-19 pandemic created a one-of-a-kind media moment that will be hard for news companies to replicate. For example, data shows that that the Omicron variant is not jumpstarting Americans’ engagement in COVID news like it did at the onset of the pandemic.

But although fewer singular storylines managed to capture the collective attention in 2021, there were still plenty of interesting media trends to analyse. Take a look at Commetric’s top five 2021 media analyses by number of readers:

1. Pfizer: Corporate Reputation Analysis Case Study

Not long ago, when a pharma company made headlines in the mainstream media, it was usually for all the wrong reasons – from the opioid crisis to high drug prices. We were so used to seeing the media demonise Big Pharma that it became common to think about pharma PR as perpetual crisis management.

However, Covid-19 changed all that. Our recent analysis concluded that journalists have started to report more favourably of pharma’s work and thatcompanies are experiencing a reputational boostas the pandemic highlights their role in developing medications and vaccines.

We found that one of the Big Pharma players which saw their reputation significantly improved was Pfizer. In November, the company announced that its vaccine had a nearly 95% efficacy rate with no serious side effects.

Pfizer was also one of the pharma companies that started rethinking the importance of their corporate brands and reexamining their marketing and communications.

One of the top US spenders on pharmaceutical marketing, it now used some of its advertising inventory for product commercials to launch a corporate campaign instead. The campaign, called “Science Will Win”, asserts that when things are most uncertain, we turn to the most certain thing there is: science.

In order to analyse the development of Pfizer‘s reputation in the media, we used our proprietary reputation analytics platform ComVix to identify the main drivers of the company’s corporate reputation and track their change in 2020 vs 2019, as well as benchmark Pfizer’s media profile against the Healthcare Sector overall.

Our analysis is based on 1,979,257 English-language articles from more than 15,000 online media outlets, published in the period 1st January 2019-31st December 2020.

Pfizer’s reputation was measured using the ComVix Reputation Index (CRI), which shows the reputation drivers’ impact on the overall corporate reputation index.

The analysis also demonstrates how Commetric’s patented Influencer Network Analysis methodology can be used to identify and rank the most influential pharma companies and CEOs in the media.

Download Pfizer: Corporate Reputation Analysis Case Study.

2. The Ready-to-Drink Trend: Can Canned Cocktails and Hard Seltzers Save the Alcohol Industry?

Almost every media discussion around alcohol-related topics starts with the fact that alcohol is going out of fashion for young generations. The decline in consumption has been in line with developments in other segments of the food and drink industry which have been influenced by the growing popularity of the health and wellness megatrend – good examples that we’ve recently analysed are the meat substitutes market and the plant-based beverages market.

However, there is one recent trend in the food and drink sector that is increasingly viewed as the saviour of the global alcohol beverages industry: the ready-to-drink (RTD) category. Predominantly focused on the younger market, RTD has undergone a resurgence, with diverse new product developments and carefully styled packaging. In fact, it has been the fastest-growing category in the beverage business.

To see how the RTD trend is unfolding in the media, we analysed 595 English-language articles published between March-August 2021.

Our media list included top mass media outlets like Reuters, the New York Times, Forbes and the Guardian, as well as leading industry publications such as The Spirits Business, Beverage Dynamics, Beverage Daily, BBC Good Food and Food & Beverage Magazine.

We found that canned cocktails were dominating the RTD media conversation:

Many publications noted that RTD cocktails are the fastest-growing alcohol beverage category in the US market, especially during lockdowns: Covid-affected period saw an increase of 86.8% year-over-year growth for all RTD cocktails, opposed to 21.5% pre-Covid.

Some journalists attributed the rise in popularity of bar-like RTD cocktails canned packaging to the vibrant and creative packaging, which is particularly attractive for social media-savvy millennials. Another factor has been the dissipating stigma that canned cocktails are low-grade or party drinks – brands have invested in campaigns that specifically framed canned cocktails as something premium.

In a way, the canned cocktail narrative arch from casual to premium is the opposite of the recent narrative arch that wine experienced when sold in can formats. While wine is a product often associated with snobbery, elitism, and even pretension, companies tapping into the new canned trend are hoping to position wine closer to the accessibility of more casually consumed drinks like beer.

3. Pride 2021: How Can Brands Steer Clear of Pink-Washing?

Every June, a growing number of brands launch rainbow-themed merchandise to celebrate Pride Month, and pink collections emerge like a horde of brightly-coloured locusts. For over 50 years, Pride Month has become a powerful economic engine, with big brands investing heavily in sponsorships, ads and merchandise to express their support for the LGBTQ+ community and to win over new consumers.

But while many comms experts argue that such corporate initiatives have played a positive role in “normalising” LGBTQ+ culture, more and more companies have started facing accusations of “pinkwashing”. In fact, criticism for “rainbow capitalism”, in which corporations are accused of boosting their image by selling LGBTQ+-themed products, has never been louder.

This criticism has been fuelled by many left-wing politicians and LGBTQ+ campaigners. For example, United States Representative Alexandria Ocasio-Cortez, a role model for many millennials and one of the most influential politicians on social media, tweeted that “just because a company slapped on a rainbow doesn’t mean they support the LGBTQ+ community”. Her tweet was followed by a surge of social media users passionately attacking brands for selling crass, rainbow-themed goods but doing little to give back to LGBTQ+ communities.

We found that while some companies were covered positively on traditional media, this certainly wasn’t the case on Twitter, where almost every big brand was accused of pink-washing and rainbow capitalism.

Analysing the Twitter debate around Pride in May and June, we found that Disney was at the centre:

Disney joined in with Pride Month celebrations on June 1, posting a tweet of some of its iconic characters walking across a Pride flag and saying: “There’s room for everyone under the rainbow.”

But this was perceived as a hollow gesture, including by some of Disney’s own employees like Alex Hirsch, a voice actor, writer and producer, who created the Disney Channel animation Gravity Falls. The film confirmed a gay romance between two characters in its series finale in 2016, but Hirsch suggested he met resistance behind the scenes.

He accused the company of hypocrisy, tweeting that Disney privately wants to cut gay scenes because they might lose “precious pennies from Russia & China”, but publicly puts a rainbow bumper sticker on Lightning McQueen. So far, his tweet has received more than 44.2K retweets and 158.2K likes.

4. Neobanking: What Comms Challenges Come With Digitising Finance?

From retail and telecommunications to construction and transport, numerous sectors have experienced a full-on digital transformation and disruption. However, one particular sector has been rather resistant to the dynamics of the all-encompassing digitalisation: financial services. Analysts have usually attributed this to the ever-tightening regulations which are hampering innovation and the focus on repairing balance sheets and cutting costs since the financial crisis.

But this is about to change with the rise of mobile banking in the US and Europe, and digital payments in China and other parts of Asia – services which the media has increasingly started to dub “neobanking“, a type of direct banking that operates exclusively online without traditional physical branches.

As the Economist put it, the future of banking could be best understood through the eyes of digital natives. The main reason people choose a bank is convenience – for older people that means a nearby branch, while for younger ones it means an excellent app.

We analysed 608 articles published between November 2020 – May 2021 in top-tier English-language outlets and found that Market disruption was the largest topic in the discussion around neobanking:

Articles within the Market disruption topic focused on how the new wave of neobanks entering the market has challenged every part of the traditional banking model by working on a narrow use case or product. Challenger banks capitalised on the limitations of traditional banking and the negative perception of the industry facilitated by the post-2008 distrust in major banking institutions.

While the rapid growth has been predominantly in the retail market, many neobanks including Starling, Tide, Revolut and, more recently, Monzo have launched business current accounts. Starling, for example, was one of the banks chosen by the British Business Bank to offer Coronavirus Business Interruption Loans (CBILs) during the pandemic.

Mainstream banks have argued that customers appreciate the security and human interaction of high street banks. Big players have usually relied on their established brands, but their legacy back-office structures and high regulatory standards have left them scrambling to keep up with the emerging fintech trends. Feeling the urgent need for innovation, many are looking for new ways to keep pace with the myriad of tech-based challengers.

5. CEOs and Social Media: Too Much Evangelisation, Not Enough Dialogue

One of the most pertinent problems of CEO comms is the CEOs’ social media activity. Fewer than half of all S&P 500 and FTSE 350 CEOs have a social media presence, and only a quarter have posted anything over the past year, according to a recent survey from business advisory firm Brunswick Group.

This means that avoidance continues to be a preference for many executives and a truly social CEO is still rare, despite the understanding among many corporate leaders that their social media competence can demonstrate not only their thought leadership but also reinforce their companies’ innovativeness and reputation.

Brunswick’s research found that by a margin of five to one employees would rather work for a leader who’s on social media, while 93% of financial readers expect to hear from a CEO online during a crisis, and 7 out of 10 people trust a CEO who’s active online. This isn’t about leaders spending more time communicating—it’s about using that time to lead more effectively.

We analysed around 1,000 English-language tweets posted by 20 CEOs between July – November 2020 and categorised them using the framework proposed by Heavey et al. (2020), published in Strategic Management Journal.

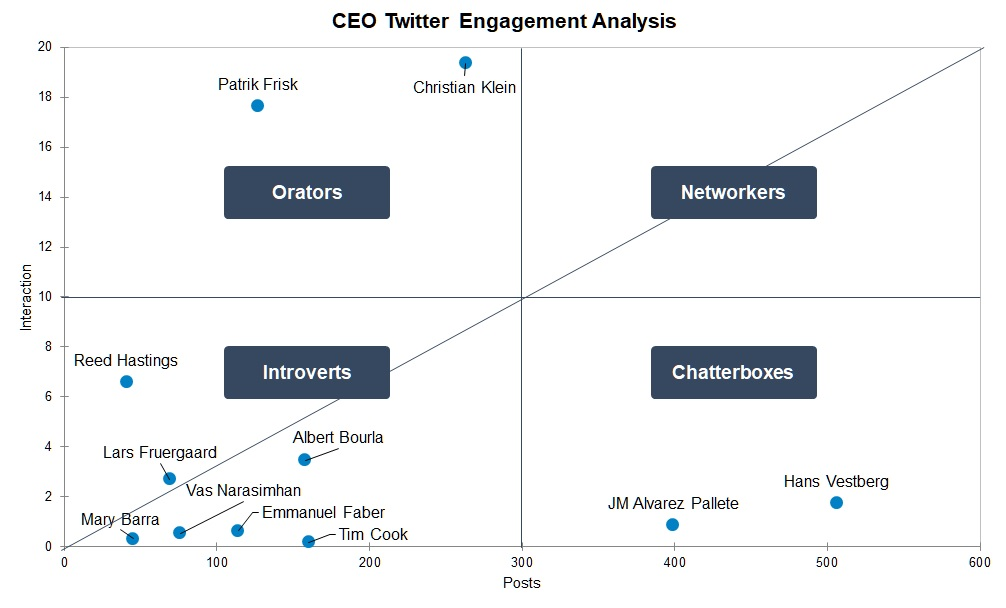

Although leaders didn’t put that much effort into starting dialogues, the tweets we mentioned received some of the highest engagement rates in our sample. Engagement was actually the main problem for all of the CEOs, as we found out by looking at the effectiveness of the posting density for each CEO.

To illustrate that, we designed a posting density matrix comparing the level of engagement (the sum of all social interactions: comments+shares+likes) to the number of posts between March 2020 – March 2021. We also took into account the number of followers for each user by comparing the interaction rate (the engagement divided by the number of followers) with the number of posts.

We found out that most CEOs in our sample classified as introverts, i. e. they are posting very little and get a small reaction from their followers. Interestingly, this was true for CEOs who are regularly in the public spotlight, such as Tim Cook and Albert Bourla (who recently received a lot of media attention because of Pfizer’s vaccine).

Hans Vestberg, who had the highest number of tweets, classified as a chatterbox – meaning that he is posting a lot, but gets very little response from his followers. Although he figured as a good example of someone who started a dialogue, that level of engagement wasn’t enough compared to the many tweets which didn’t get such good response rates.

The most successful CEOs in our sample were classified as orators – meaning that they are not posting much, but their posts hit the target.

Under Armour CEO Patrik Frisk, who has just 1741 followers, received 27,625 likes and 3028 shares of his 127 posts, as 14% of his audience was active, giving him 241 engagements per post. Many of the engagements were due to Under Armour‘s #RunToVote campaign, whose aim was to educate, mobilise, and empower Americans so as to increase voter turnout.