- As CEOs have been some of the most often quoted spokespeople during the crisis, we decided to employ our AI-based CEO Media Visibility Tracker to see which business leaders were most prominent since the start of 2021.

- We found that big five tech superstars – Elon Musk, Jeff Bezos, Mark Zuckerberg, Sundar Pichai and Tim Cook – had the highest centrality in the media, while CEOs such as Jack Dorsey, David Solomon and Doug McMillon maintained a consistent media presence.

- In addition, there were some CEOs, including Albert Bourla, Christian Sewing and Ramon Laguarta, whose media visibility has been growing thanks to their involvement in debates around hot topics like ESG.

While CEOs focused on the Covid-induced business operations emergencies in 2020, many business leaders now are looking ahead, betting that mass vaccination programs will lead to something of an economic boom after the dust of the pandemic settles.

Alongside doctors and academics, CEOs have been some of the most often quoted spokespeople during the crisis. Our own research found that during the first months of the pandemic, CEOs from the Financial Services industry were the most often quoted ones, followed by those from the Industrial, Health and Retail sectors.

But this attention to executives is not a new phenomenon. It has to do with a growing trend in journalism – the ever-closer focus on the CEO as a personality. An inordinate amount of journalistic effort is dedicated to telling the stories of larger-than-life hyperproductive figures who take bold decisions and are masters of ineffable management concepts such as “leadership”.

In management theory, this focus on business leaders is often dubbed “the cult of the CEO” and is tied to the media’s treatment of CEOs as masters of the universe. Journalists, alongside investors and boards, are placing excessive significance on CEO pedigrees and track records, and often attribute business outcomes to the CEOs’ capabilities.

The comparatively young field of reputation management has already seen many examples of theoretical and empirical works trying to pin down the factors that exert the most decisive influence on corporate reputation. Academics and practitioners have traditionally focused on things like financial performance, products and services, and corporate social responsibility. However, there is one additional factor which is starting to receive more and more attention: the CEO.

Tech superstars at the top

But which CEOs have been most prominent so far this year and why? In order to find out, we decided to employ our AI-based CEO Media Visibility Tracker, which just won the Best in Marketing Technology In2 SABRE Award 2021.

Our tracker utilises advanced AI to measure the media and social media visibility of 150 CEOs of Fortune Global Companies and to identify the business events driving their image in the media.

The tracker uses two types of metrics: “centrality” and “number of articles mentioning a specific business event”. Centrality measures CEO’s visibility in top-tier online media outlets, such as the New York Times, the Financial Times, the Guardian, Reuters, Bloomberg, Forbes, as well as on Twitter. It is a metric similar to Google’s Page Rank, applying a mathematical method to measure the quantity and quality of connections between a CEO and the media outlets and Twitter users that reference them.

The number of articles mentioning a specific business event identifies the type of news around CEOs that drives traction with the media. Unlike media analytics platforms that categorise entities or topics, Commetric’s platform can disambiguate sentence structure to classify the business events that drive CEO visibility and image.

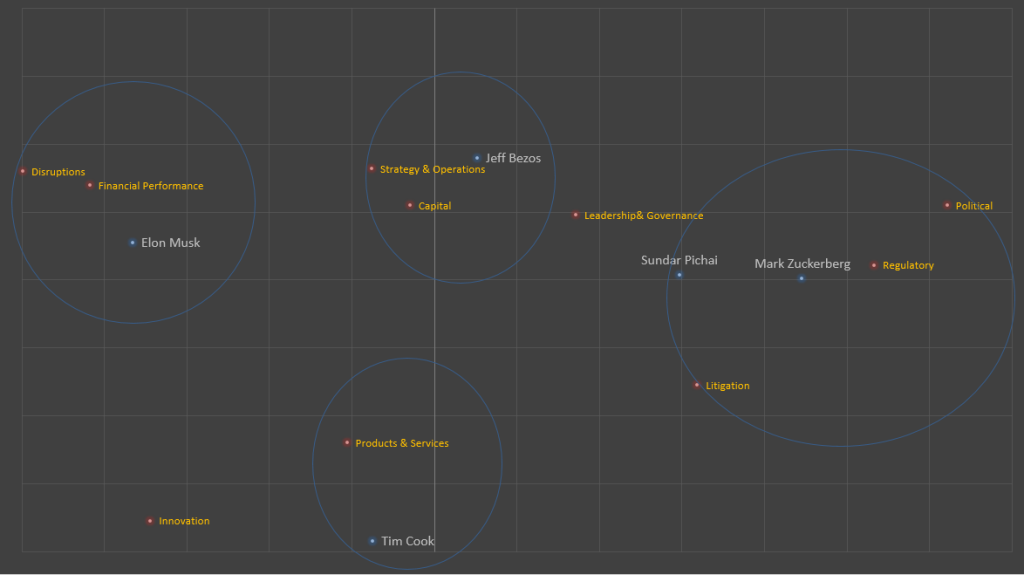

We found that big five tech superstars – Elon Musk, Jeff Bezos, Mark Zuckerberg, Sundar Pichai and Tim Cook – had the highest centrality indexes between January-May 2021.

The following correspondence analysis map illustrates their proximity to the topics which drove the media conversation around them.

For Elon Musk, a celebrity CEO who constantly receives media attention, the two most prominent media articles involved Financial Performance and Disruption.

Media stories around Financial Performance were particularly ubiquitous when the Tesla and SpaceX CEO became the world’s richest person in March. His reaction was equally newsworthy and hit many headlines: “How strange,” Musk tweeted in response to the news, following that up by saying “Well, back to work…”

He also took to Twitter to promise a $100 million prize for developing the “best” technology to capture carbon dioxide emissions, generating a fair share of media articles. At the beginning of the year, he also told Fortune Magazine he’s “super fired up” Biden’s focus on the environment and wants to find a way to help out on the administration’s initiatives for expanding green energy.

A similar political comment shaped the discussion around Mark Zuckerberg. The Facebook CEO, who usually tries to stay away from politics, featured in many media reports for acknowledging at a company-wide meeting that Biden will be the next president while Trump was still arguing that the election was rigged. He also featured in many pieces around Regulation when he proposed limited reforms of Section 230 of the Communications Decency Act.

But Zuckerberg was attacked by Apple CEO Tim Cook, who launched an attack on business models that prioritise engagement above all and hoover up user data to target users with advertising.

Cook said that technology doesn’t require that much personal data across dozens of websites and apps, in order to succeed, as advertising existed and thrived for decades without it. He added that at a moment of rampant disinformation and conspiracy theories juiced by algorithms, “we can no longer turn a blind eye to a theory of technology that says all engagement is good engagement”.

The media focused on Jeff Bezos‘ Strategy and Operations as Amazon announced in February that he would leave his post later this year, transitioning to executive chairman of the company’s board and dedicating more time toward initiatives like the Bezos Earth Fund, his Blue Origin spaceship company, The Washington Post and the Amazon Day 1 Fund.

In the meantime, Sundar Pichai scored Leadership and Governance points as he made the announcement that Google would make its facilities available for Covid-19 vaccination sites to help speed the rollout of inoculations as part of a $150 million initiative to promote vaccine education and equitable access. Pichai said Google’s new funding will include $100 million in advertising grants for the US Centers for Disease Foundation, the World Health Organization, and nonprofits around the globe and $50 million for public health agencies to reach underserved communities with vaccine-related information.

Steady performers

Another group of CEOs, including Jack Dorsey, David Solomon, Doug McMillon and Emma Walmsley, have also had a steady level of media visibility so far in 2021, even though they didn’t reach the heights of the aforementioned big five.

Twitter CEO Jack Dorsey was under the media spotlight when the mass media reported that he “showed some of the first flashes of conscience”, sticking what amounted to warning labels on some of Trump‘s most offensively mendacious messages. Dorsey was also reported to have resisted calls to repeal Section 230, saying it would mean platforms would end up stifling free speech in a bid to avoid being hit with a deluge of lawsuits.

David Solomon received a flurry of media attention after announcing that Goldman Sachs it will carry out IPOs only for companies that have at least one woman or non-white board member. According to some commentators, this pledge would make Goldman one of the first investment banks to mandate diversity among clients. The bank has had a long-standing reputation as the ultimate ‘old boys’ club’, reinforced by articles such as New York Magazine’s ‘The Head of Goldman Sachs Will Always Be Bald’.

As Wall Street has been trying to address its gender problem for more than a decade, there were other positive developments: for example, HSBC has come in equal seventh among 100 FTSE companies for female representation on its board (46%). Meanwhile, Jane Fraser’s rise to CEO of Citigroup – the first woman to lead a big Wall Street bank – hit many headlines.

For more on this topic, read our analysis “Gender Equality: Has Covid Intensified the Debate?”

In a rare comment on politics, Walmart CEO Doug McMillon, who also serves as the Business Roundtable’s chairman, had the highest media visibility when he expressed well-wishes to Biden. Following the insurrection at the US Capitol by Trump supporters on January 6, Walmart and other major companies engaged in rethinking their political activity by suspending contributions to the 147 Republicans who tried to overturn Biden’s victory.

McMillon said it makes sense that companies are reviewing their political giving and that businesses won’t remain on the sidelines for long: “Not participating in the process…could create other issues. There is still a role for business to play. We just want to do it in a thoughtful way. He also suggested that companies could “reward the centrists” in order to encourage more bipartisan behaviour.

This comes at a time when people are increasingly turning to business leaders for guidance – according to the 2021 Edelman Trust Barometer, more than 80% of those surveyed expect CEOs to speak publicly on societal issues, such as the impact of the pandemic, local concerns and job automation, while business is the only institution deemed ethical and competent by people globally.

For more on this topic, read our analysis: “CEOs Reaction to Biden: The Dawn of CEO Activism?”

In contrast, GlaxoSmithKline chief Emma Walmsley had a high centrality index when the American activist hedge fund Elliott, which has bought a multibillion-pound stake in Glaxo, pressured her and began to engage with other leading fund managers that own big stakes in the FTSE 100 drugs maker. The U.K. government has asked officials to keep a close eye on Elliott Management’s plans for GlaxoSmithKline, fearing the activist investor could push to split up the company or have it subsumed by a U.S. rival, The Times reported.

New stars?

A third category of CEOs, including Albert Bourla, Bernard Arnault Jamie Dimon, Christian Sewing and RamonLaguarta, saw their media visibility increase throughout 2021.

Albert Bourla has been in the media spotlight ever since Pfizer announced that its vaccine had a nearly 95% efficacy rate with no serious side effects.

Pfizer was also one of the pharma companies that started rethinking the importance of their corporate brands and reexamining their marketing and communications. In January, Pfizer unveiled its most significant brand refresh in about 70 years to communicate its new identity as a science-driven company creating prescription drugs and vaccines – what CEO Albert Bourla called a “smaller, science-based company.” This represented a move away from the traditional “house of brands” strategy that focuses on building awareness of product brands, often at the expense of the corporate brand.

One of the top US spenders on pharmaceutical marketing, it now used some of its advertising inventory for product commercials to launch a corporate campaign instead. The campaign, called “Science Will Win”, asserts that when things are most uncertain, we turn to the most certain thing there is: science.

A key part of this rebrand, as well as of the comms strategies of nearly all pharma giants, has become the focus on CEO communications as a means to bolstering corporate branding and reputation. News mentioning the CEO of the 10 pharma companies we recently researched – Abbvie, Amgen, AstraZeneca, Eli Lilly, Gilead, GSK, Johnson &Johnson, Merck, Novartis, and Pfizer – more than doubled in volume.

These companies are bolstering their CEOs’ presence in the media to explain their approach to producing drugs and vaccine trials. As a result, these CEOs have all now made it to the top 50 of the most visible CEOs, which would have been highly unlikely before the pandemic.

For instance, AstraZeneca CEO Pascal Soriot and Pfizer head Albert Bourla are now in the top 20 most visible CEOs in the rankings. Almost all their coverage is driven by Innovation, a core feature of all major pharmaceutical companies’ operations and especially as work on Covid-19 treatments and vaccines progresses.

The tracker shows the pandemic’s impact on the visibility of big pharma’s leaders, as the sector takes the opportunity to overcome its poor reputation and emphasise how its core business is helping.

LVMH chief executive Bernard Arnault increased his share of voice thanks to Financial Performance stories when he unseated Elon Musk as the world’s second-richest person in May. Arnault and his family control 47.5% of LVMH, which owns over 70 brands including Louis Vuitton, Christian Dior, Fendi, Moët & Chandon, Hennessy, and Veuve Clicquot.

Meanwhile, JPMorgan Chief Executive Jamie Dimon earned his visibility points when he told Congress his company stepped up efforts to bank underserved communities, ahead of scrutiny into their lending to Americans facing hard times during the pandemic. Dimon said that JPMorgan took steps to make sure those in need, including those without access to traditional banking services, received each round of stimulus payments quickly.

Other bank CEOs like Bank of America’s BrianMoynihan and Charlie Scharf of Wells Fargo & Co. underlined the loans and services they extended during the crisis, including to underserved communities. They pointed to their roles disbursing loans under the government’s Paycheck Protection Program, an initiative designed to help small businesses keep workers on their payrolls.

Deutsche Bank Chief Executive Officer Christian Sewing said the bank is seeking to become “a sustainability leader”, as it faces accusations from environmental groups Greenpeace and Urgewald that it is not doing enough on climate. The bank also brought forward to 2023 the goal of facilitating more than 200 billion euros ($244 billion) in sustainable financing and investments.

Sewing started gaining prominence as part of the dynamic media conversation around Environmental, social and corporate governance (ESG) – a way of handling a company’s operations which takes into account not only the potential financial returns of an investment but its social impact as well. Leading global lenders have been showcasing their commitment to sustainable investing, as pressure builds on banks to support the transition to a low-carbon and more environmentally friendly economy.

Our recent research showed that, in the early days of the pandemic, many commentators were worried that COVID would preoccupy the corporate world and companies wouldn’t be able to sustain any ESG commitments.

However, the pandemic did exactly the opposite and magnified the impact of ESG on strategy and risk. In fact, well-managed crises can present companies with opportunities to gain trust and respect by developing relevant ESG efforts. In the context of the pandemic, many companies are expected to play a greater role in helping not only employees but whole communities by manufacturing personal protective equipment (PPE), ventilators, hand sanitisers and masks.

Another CEO, PepsiCo’s Ramon Laguarta, also stood out in the ESG debate as it doubled down on a decades-long effort to cut calories in its products and engineer new, healthier ones. In the company’s 2021 statement to investors, the Pepsi CEO spoke about the company’s “special focus on no sugar beverages” and its continued efforts to “reduce added sugars, sodium and saturated fat in many of our products.”

Laguarta‘s new focus comes at a time when health quite naturally moved into the spotlight for many consumers. Boosting the immune system quickly became a priority and, because people ended up cooking more at home during lockdowns, mindful eating has gained traction. Health and wellness accounted for about one-fifth of total packaged food value sales globally in 2020 because consumers increasingly seek natural products, as opposed to supplements and pill formats, that help them to stay healthy or lessen the potential impact of a Covid infection.

Key takeaways for PR and communications practitioners

Public relations agencies and internal comms teams could use the CEO Media Visibility Tracker in three ways:

- At a conceptual level, the tracker could help comms practitioners to focus on the relevant drivers to communicate, which should underpin the CEO brand idea and positioning. Corporate reputation drivers should be used as filters for message generation and prioritised in line with the image-transfer needs of the company brand.

- At a strategic-planning level, the tracker can be used to ensure that the chosen media channels fit and amplify the drivers to be communicated. The performance-related drivers can be enhanced in mainstream media, for example, but it probably will be easier to enhance personality in social media channels.

- At an operational level, the CEO Media Visibility Tracker could be used as an integral part of corporate, communication, and brand-tracking studies to assess CEO image and corporate reputation and identify differences or gaps in positioning versus company brand image and key competitors. They also may evaluate the evolution of CEO brand image over time, assess the effectiveness of public-relations campaigns, and quantify the added value of CEO brand image for overall company performance. This will help to justify public-relations investments and ensure that CEO image can be managed as a brand rather than left to affect the company brand passively.